Question: Question 3 7 2 pts Fred is an assistant vice president at Platinum Corporation. Fred, along with several other assistant vice presidents of the company

Question

pts

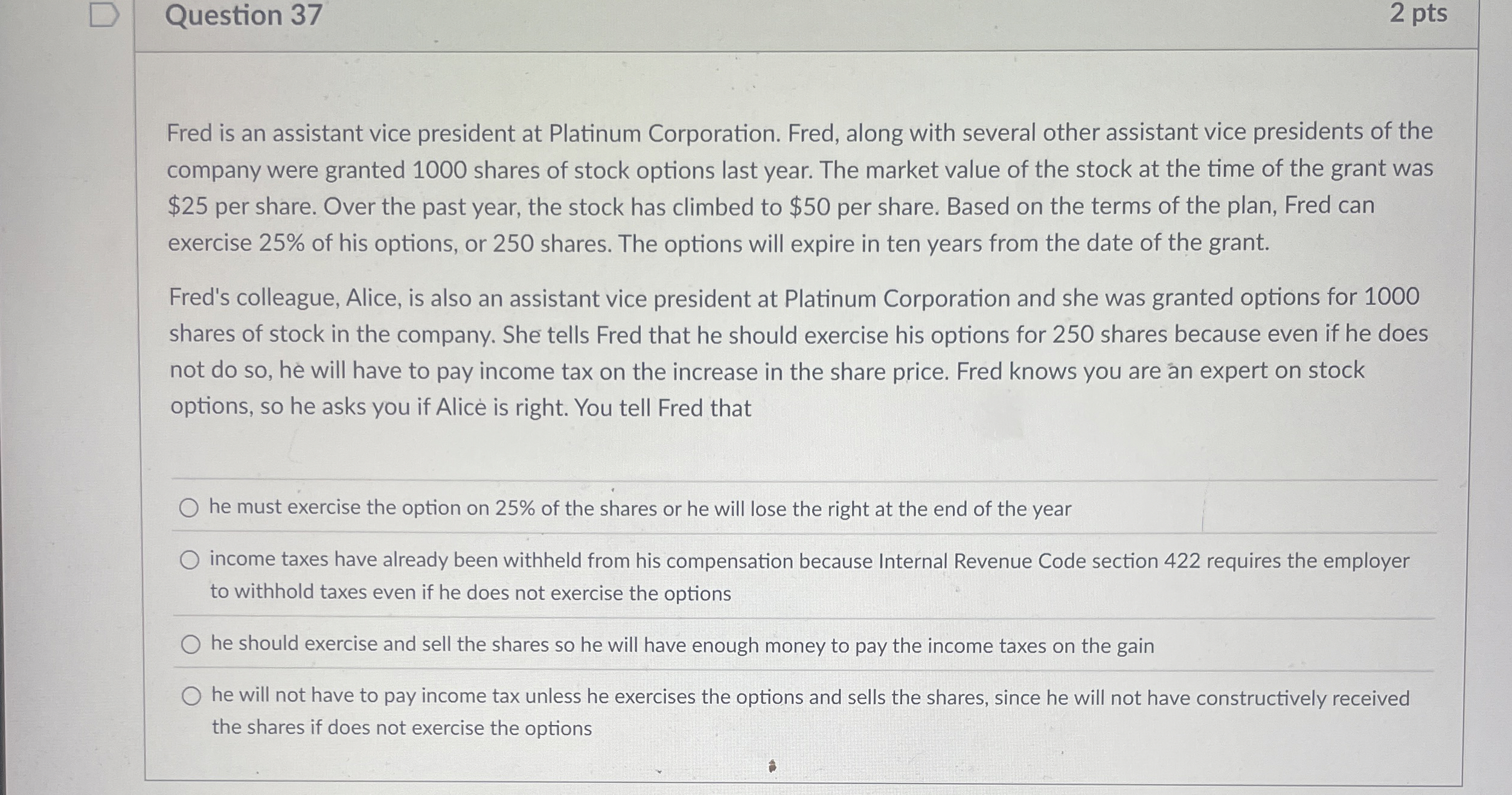

Fred is an assistant vice president at Platinum Corporation. Fred, along with several other assistant vice presidents of the company were granted shares of stock options last year. The market value of the stock at the time of the grant was $ per share. Over the past year, the stock has climbed to $ per share. Based on the terms of the plan, Fred can exercise of his options, or shares. The options will expire in ten years from the date of the grant.

Fred's colleague, Alice, is also an assistant vice president at Platinum Corporation and she was granted options for shares of stock in the company. She tells Fred that he should exercise his options for shares because even if he does not do so he will have to pay income tax on the increase in the share price. Fred knows you are an expert on stock options, so he asks you if Alice is right. You tell Fred that

he must exercise the option on of the shares or he will lose the right at the end of the year

income taxes have already been withheld from his compensation because Internal Revenue Code section requires the employer to withhold taxes even if he does not exercise the options

he should exercise and sell the shares so he will have enough money to pay the income taxes on the gain

he will not have to pay income tax unless he exercises the options and sells the shares, since he will not have constructively received the shares if does not exercise the options

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock