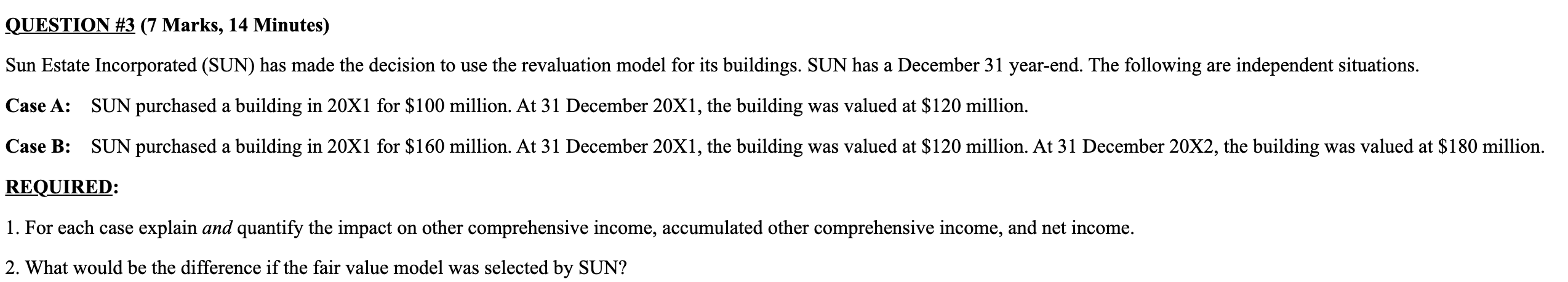

Question: QUESTION # 3 ( 7 Marks, 1 4 Minutes ) Sun Estate Incorporated ( SUN ) has made the decision to use the revaluation model

QUESTION # Marks, Minutes

Sun Estate Incorporated SUN has made the decision to use the revaluation model for its buildings. SUN has a December yearend. The following are independent situations.

Case A: SUN purchased a building in X for $ million. At December X the building was valued at $ million.

Case B: SUN purchased a building in X for $ million. At December X the building was valued at $ million. At December X the building was valued at $ million.

REQUIRED:

For each case explain and quantify the impact on other comprehensive income, accumulated other comprehensive income, and net income.

What would be the difference if the fair value model was selected by SUN?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock