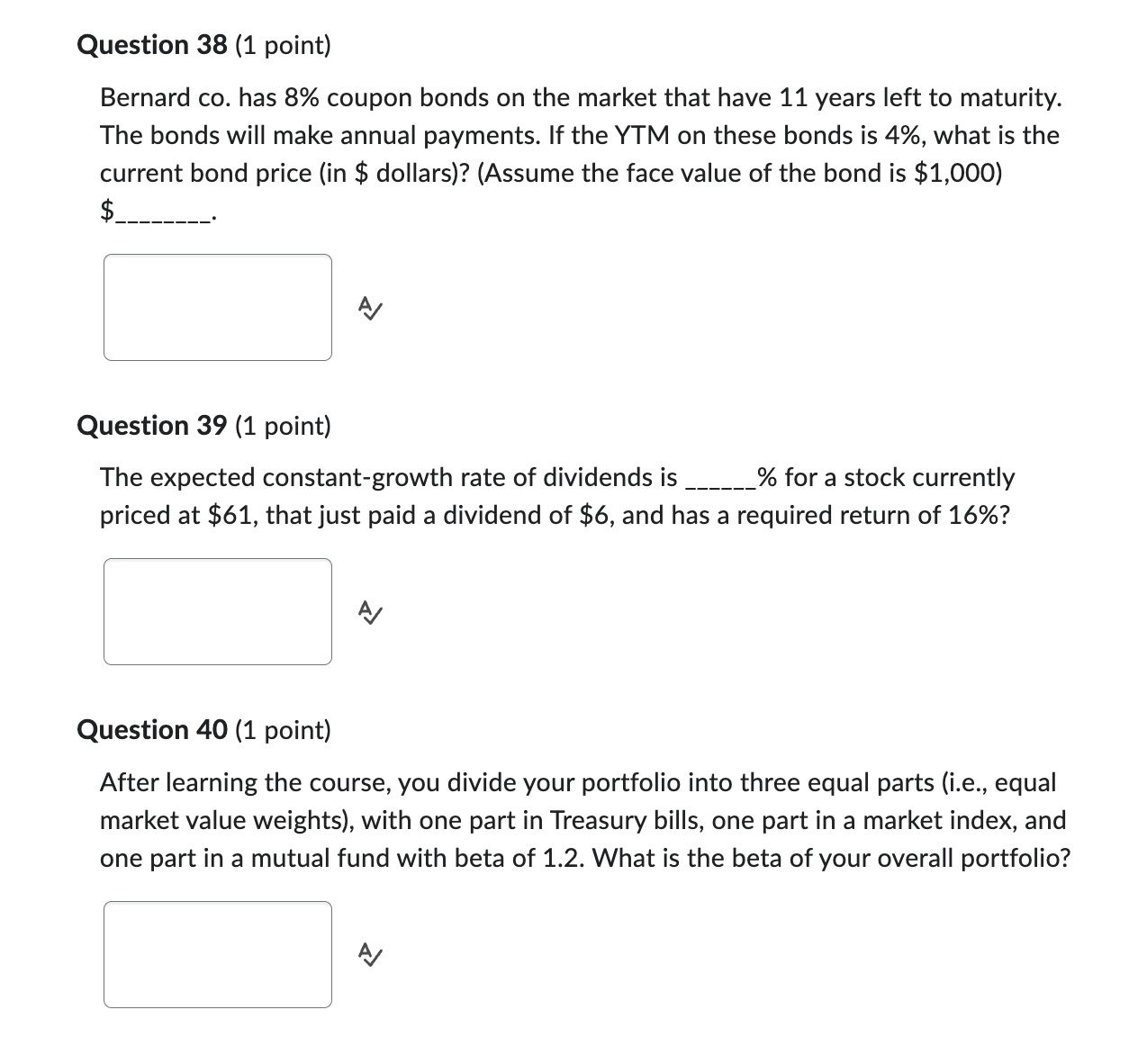

Question: Question 3 8 ( 1 point ) Bernard co . has 8 % coupon bonds on the market that have 1 1 years left to

Question point

Bernard co has coupon bonds on the market that have years left to maturity.

The bonds will make annual payments. If the YTM on these bonds is what is the

current bond price in $ dollarsAssume the face value of the bond is $

$

Question point

The expected constantgrowth rate of dividends is for a stock currently

priced at $ that just paid a dividend of $ and has a required return of

Question point

After learning the course, you divide your portfolio into three equal parts ie equal

market value weights with one part in Treasury bills, one part in a market index, and

one part in a mutual fund with beta of What is the beta of your overall portfolio?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock