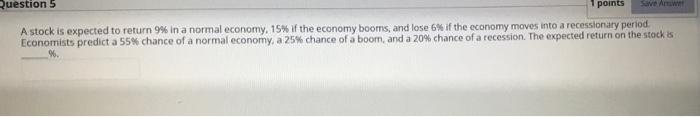

Question: Ruestion points A stock is expected to return 9% in a normal economy, 15% of the economy booms, and lose 6% if the economy moves

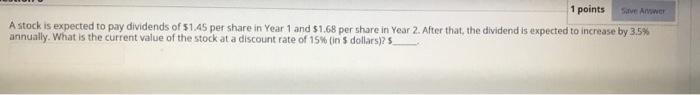

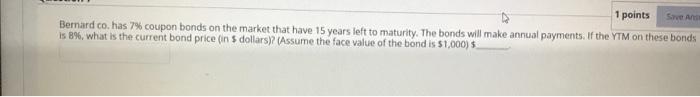

Ruestion points A stock is expected to return 9% in a normal economy, 15% of the economy booms, and lose 6% if the economy moves into a recessionary period. Economists predict a 55% chance of a normal economy, a 25% chance of a boom, and a 20% chance of a recession. The expected return on the stock Save Awwer 1 points A stock is expected to pay dividends of 51.45 per share in Year 1 and 51.68 per share in Year 2. After that, the dividend is expected to increase by 3.5% annually. What is the current value of the stock at a discount rate of 15% in dollars) 1 points Bernard co. has 7% coupon bonds on the market that have 15 years left to maturity. The bonds will make annual payments. If the YTM on these bonds Is 8%, what is the current bond price in dollars)? (Assume the face value of the bond is $1,000) $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts