Question: Question 3 (8 marks) a. Billy is considering the following two saving plans: Plan A: If Billy deposits $30,000 in the investment account for two

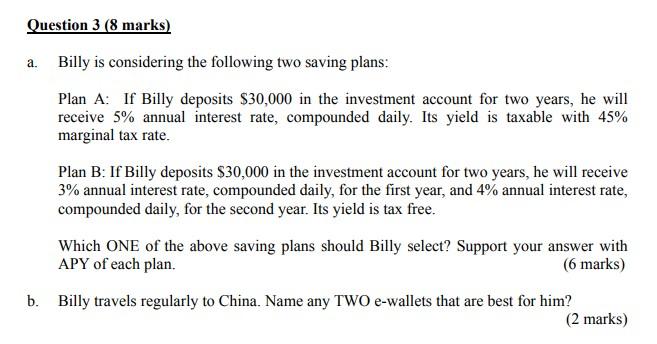

Question 3 (8 marks) a. Billy is considering the following two saving plans: Plan A: If Billy deposits $30,000 in the investment account for two years, he will receive 5% annual interest rate, compounded daily. Its yield is taxable with 45% marginal tax rate. Plan B: If Billy deposits $30,000 in the investment account for two years, he will receive 3% annual interest rate, compounded daily, for the first year, and 4% annual interest rate, compounded daily, for the second year. Its yield is tax free. Which ONE of the above saving plans should Billy select? Support your answer with APY of each plan. (6 marks) b. Billy travels regularly to China. Name any TWO e-wallets that are best for him? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts