Question: Question 3 (9 marks) Consider the following information about a non-dividend paying stock: The current stock price is $36, and its return standard deviation is

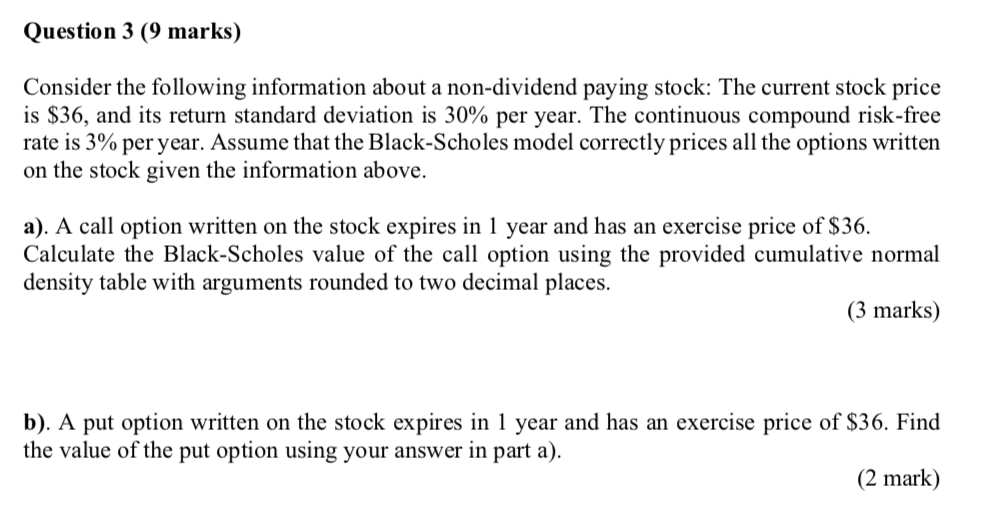

Question 3 (9 marks) Consider the following information about a non-dividend paying stock: The current stock price is $36, and its return standard deviation is 30% per year. The continuous compound risk-free rate is 3% per year. Assume that the Black-Scholes model correctly prices all the options written on the stock given the information above. a). A call option written on the stock expires in 1 year and has an exercise price of $36. Calculate the Black-Scholes value of the call option using the provided cumulative normal density table with arguments rounded to two decimal places. (3 marks) b). A put option written on the stock expires in 1 year and has an exercise price of $36. Find the value of the put option using your answer in part a). (2 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts