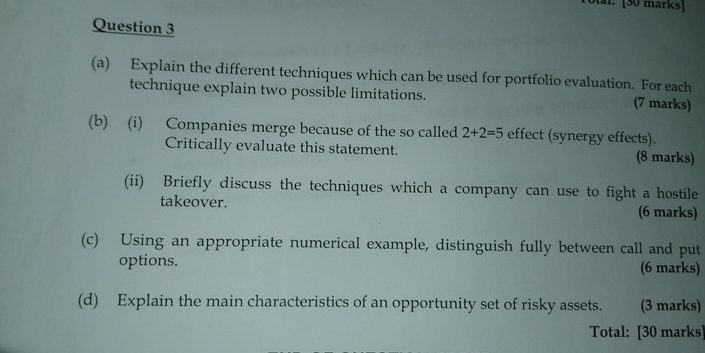

Question: Question 3 ( a ) Explain the different techniques which can be used for portfolio evaluation. For each technique explain two possible limitations . (

Question

a Explain the different techniques which can be used for portfolio evaluation. For each technique explain two possible limitations

marks

bi Companies merge because of the so called effect synergy effects Critically evaluate this statement.

marks

ii Briefly discuss the techniques which a company can use to fight a hostile takeover.

marks

c Using an appropriate numerical example, distinguish fully between call and put options.

marks

d Explain the main characteristics of an opportunity set of risky assets.

marks

Total: marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock