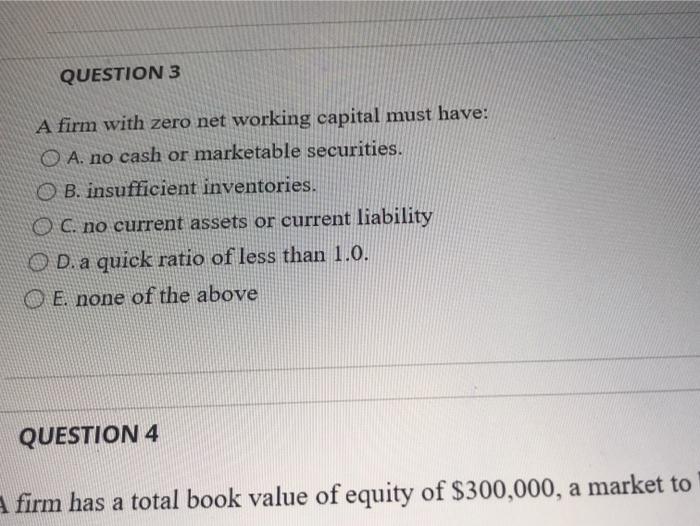

Question: QUESTION 3 A firm with zero net working capital must have: O A. no cash or marketable securities. O B. insufficient inventories. O C. no

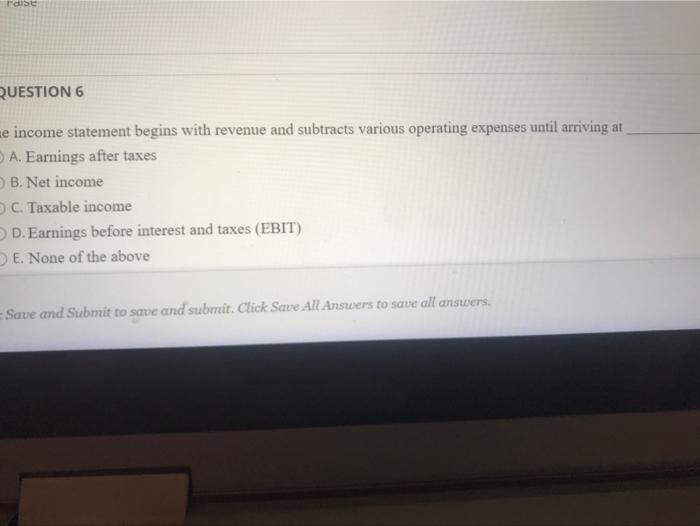

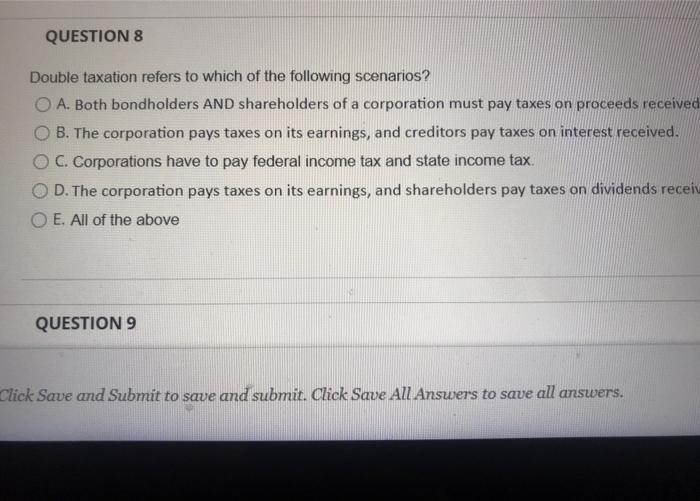

QUESTION 3 A firm with zero net working capital must have: O A. no cash or marketable securities. O B. insufficient inventories. O C. no current assets or current liability O D. a quick ratio of less than 1.0. O E. none of the above QUESTION 4 firm has a total book value of equity of $300,000, a market to rast QUESTION 6 e income statement begins with revenue and subtracts various operating expenses until arriving at A. Earnings after taxes B. Net income C. Taxable income D. Earnings before interest and taxes (EBIT) E. None of the above Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 8 Double taxation refers to which of the following scenarios? A. Both bondholders AND shareholders of a corporation must pay taxes on proceeds received B. The corporation pays taxes on its earnings, and creditors pay taxes on interest received. O C. Corporations have to pay federal income tax and state income tax O D. The corporation pays taxes on its earnings, and shareholders pay taxes on dividends receiv O E. All of the above QUESTION 9 Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts