Question: Question 3. a) Write a short note to a client explaining the following issues: 1) Outline the differences between Cost and Management Accounting and Financial

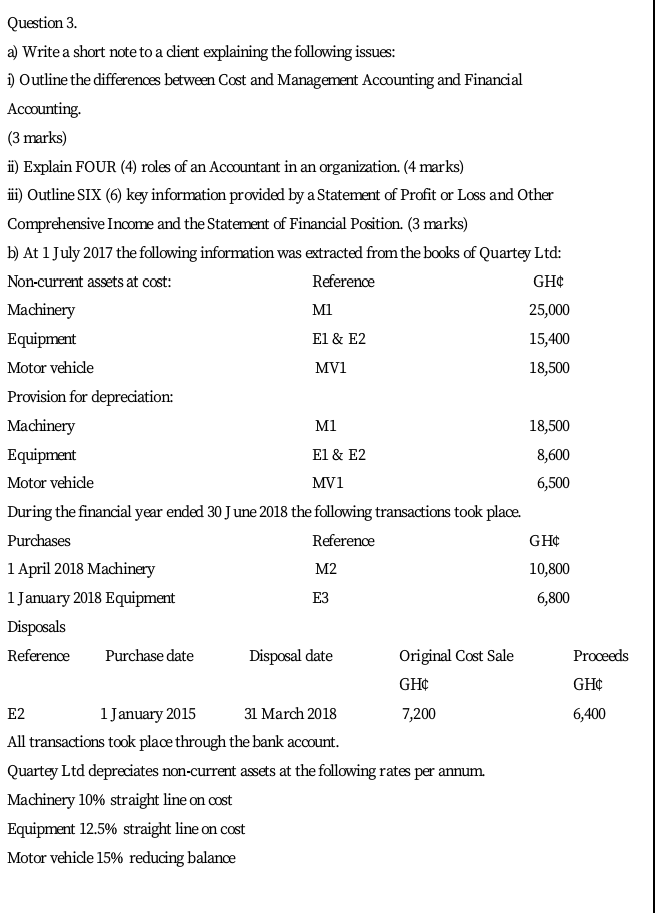

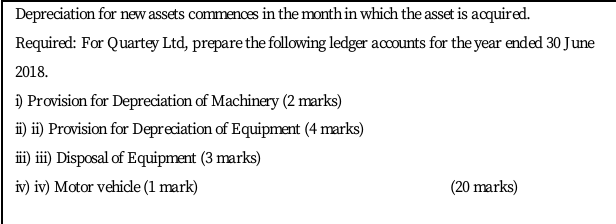

Question 3. a) Write a short note to a client explaining the following issues: 1) Outline the differences between Cost and Management Accounting and Financial Accounting. (3 marks) ii) Explain FOUR (4) roles of an Accountant in an organization. (4 marks) iii) Outline SIX (6) key information provided by a Statement of Profit or Loss and Other Comprehensive Income and the Statement of Financial Position. (3 marks) b) At 1 July 2017 the following information was extracted from the books of Quartey Ltd: Non-current assets at cost: Reference GH Machinery MI 25,000 Equipment El & E2 15,400 Motor vehicle MV1 18,500 Provision for depreciation: Machinery Mi 18,500 Equipment El & E2 8,600 Motor vehicle Mvi 6,500 During the financial year ended 30 June 2018 the following transactions took place. Purchases Reference GH 1 April 2018 Machinery M2 10,800 1 January 2018 Equipment E3 6,800 Disposals Reference Purchase date Disposal date Original Cost Sale Proceeds GHC GHC E2 1 January 2015 31 March 2018 7,200 6,400 All transactions took place through the bank account. Quartey Ltd depreciates non-current assets at the following rates per annum. Machinery 10% straight line on cost Equipment 12.5% straight line on cost Motor vehicle 15% reducing balance Depreciation for new assets commences in the month in which the asset is acquired. Required: For Quartey Ltd, prepare the following ledger accounts for the year ended 30 June 2018. i) Provision for Depreciation of Machinery (2 marks) ) ii) Provision for Depreciation of Equipment (4 marks) ii) ii) Disposal of Equipment (3 marks) iv) iv) Motor vehicle (1 mark) (20 marks) Question 3. a) Write a short note to a client explaining the following issues: 1) Outline the differences between Cost and Management Accounting and Financial Accounting. (3 marks) ii) Explain FOUR (4) roles of an Accountant in an organization. (4 marks) iii) Outline SIX (6) key information provided by a Statement of Profit or Loss and Other Comprehensive Income and the Statement of Financial Position. (3 marks) b) At 1 July 2017 the following information was extracted from the books of Quartey Ltd: Non-current assets at cost: Reference GH Machinery MI 25,000 Equipment El & E2 15,400 Motor vehicle MV1 18,500 Provision for depreciation: Machinery Mi 18,500 Equipment El & E2 8,600 Motor vehicle Mvi 6,500 During the financial year ended 30 June 2018 the following transactions took place. Purchases Reference GH 1 April 2018 Machinery M2 10,800 1 January 2018 Equipment E3 6,800 Disposals Reference Purchase date Disposal date Original Cost Sale Proceeds GHC GHC E2 1 January 2015 31 March 2018 7,200 6,400 All transactions took place through the bank account. Quartey Ltd depreciates non-current assets at the following rates per annum. Machinery 10% straight line on cost Equipment 12.5% straight line on cost Motor vehicle 15% reducing balance Depreciation for new assets commences in the month in which the asset is acquired. Required: For Quartey Ltd, prepare the following ledger accounts for the year ended 30 June 2018. i) Provision for Depreciation of Machinery (2 marks) ) ii) Provision for Depreciation of Equipment (4 marks) ii) ii) Disposal of Equipment (3 marks) iv) iv) Motor vehicle (1 mark) (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts