Question: QUESTION 3 Andreas & Giorgos Machine Shop is evaluating the proposed acquisition of a new milling machine. The milling machine costs 175,000, and it would

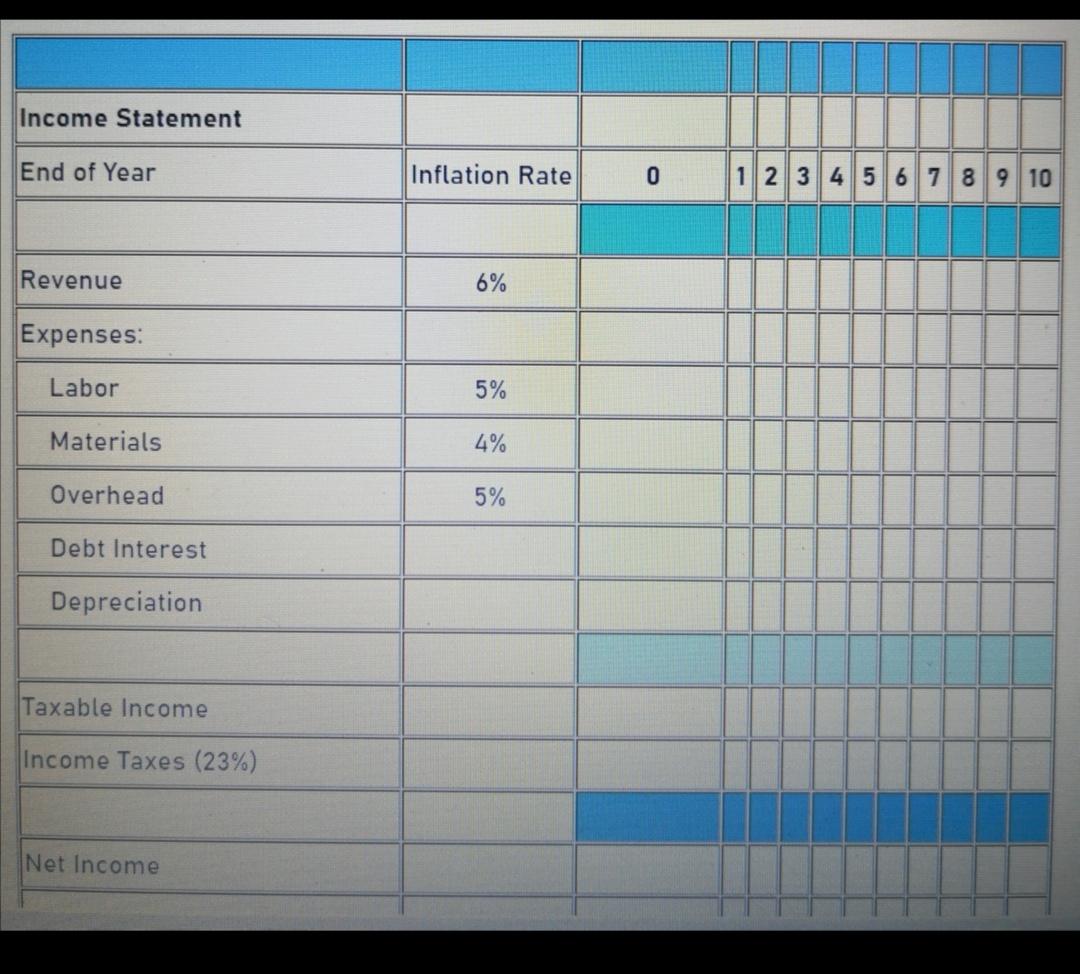

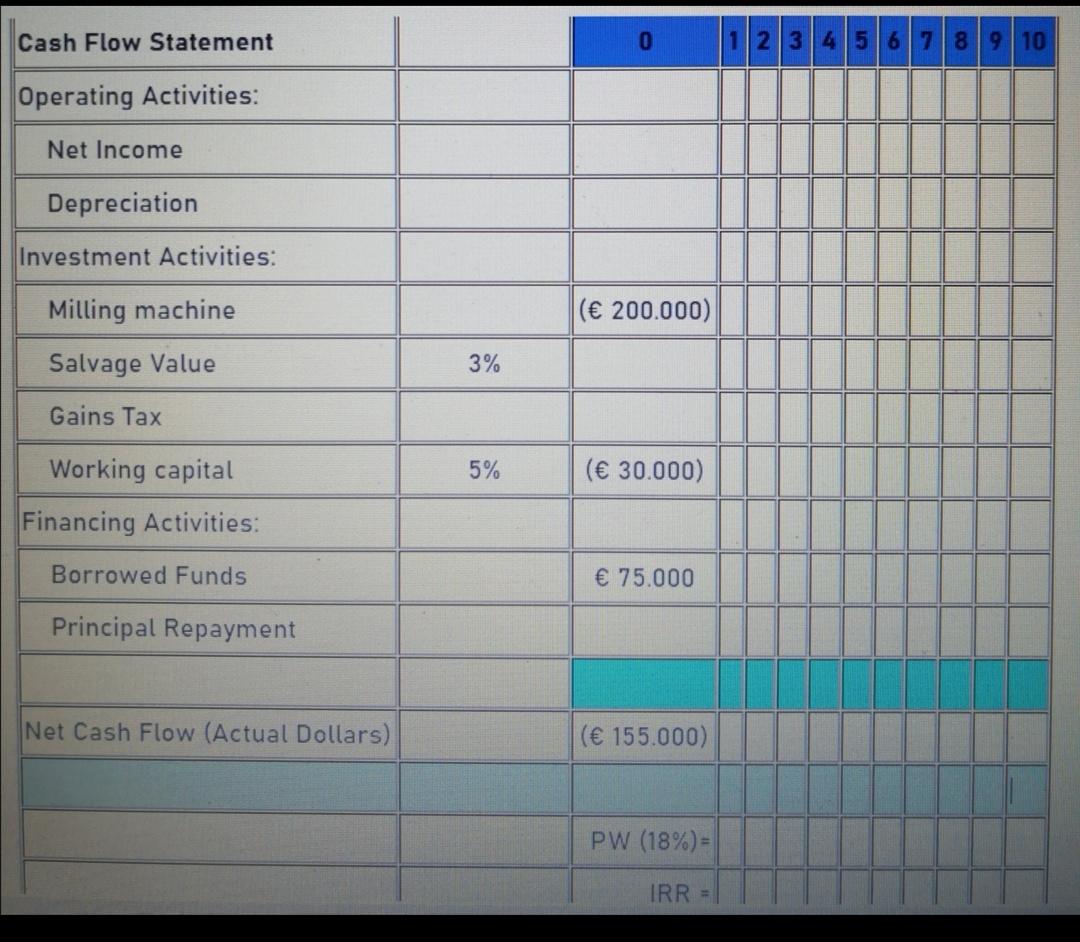

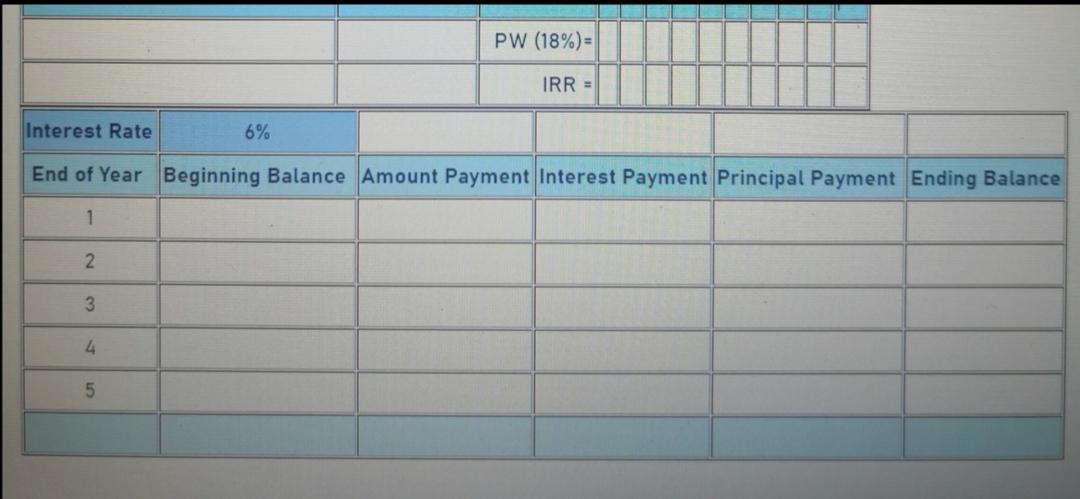

QUESTION 3 Andreas & Giorgos Machine Shop is evaluating the proposed acquisition of a new milling machine. The milling machine costs 175,000, and it would cost another 25,000 to modify it for special use by the company. To finance this investment, the Company is to secure a loan of the order of 75,000 from a local bank at an interest rate of 6%. The rest will be invested by the Company's own equity. The milling machine has an estimated service life of ten years, with a zero-salvage value. The milling machine will be depreciated by the straight-line method. 1 Page With this milling machine, the company will be able to generate additional annual revenues of 150,000 (Year zero). These revenues are expected to rise by 6% on a year-by-year basis. However, it requires a specially trained operator to run the machine. This will entail at Year-zero values, 50,000 in annual labour, 40,000 in annual material expenses, and another 25,000 in annual overhead (power and utility) expenses. Labour cost is expected to rise by 5% annually, materials by 4% annually, and overhead by 5% annually. It also requires an investment in working capital in the amount of 30,000, which will be recovered in full at the end of year ten with an inflation rate of 5%. The marginal tax rate is of the order of 23%. In summary: Project Nature: Purchase of a new milling machine Financial Data: o Investment activities: Capital expenditure (milling machine): 200,000. Seventy-five thousand euros (75,000) securing a loan with an interest rate of 6%. The rest by own equity. Project life: 10 years Salvage value: 0 Investment in working capital: 30,000, which will be recovered in full at the end of year 10 with an inflation rate of 5%. Operating activities: Annual operating revenue (YO): 175,000 Annual operating expenses: Labour (YO): 50,000, increasing by 5%, each year thereafter year zero. Materials (YO): 40,000 increasing by 4%, each year thereafter year zero. Overhead (YO): 25,000 increasing by 5%, each year thereafter year zero. Accounting Data: O Depreciation method: ten year straight-line Income tax rate; 23% MARR after tax: 18% O O Determine: a) The year-by-year depreciation allowances, [5 marks] b) The loan structure (15 marks) c) The year-by-year cash flow for the project at a 23% marginal tax rate, [20 marks] d) The net present worth of the project at the company's MARR of 18% (after tax) and the project IRR. [10 marks] Income Statement End of Year Inflation Rate 0 1 2 3 4 5 6 7 8 9 10 Revenue 6% Expenses: Labor 5% Materials 4% Overhead 5% Debt Interest Depreciation Taxable income Income Taxes (23%) Net Income Cash Flow Statement 0 11|2| 34 6 7 8 9 10 8 Operating Activities: Net Income Depreciation Investment Activities: Milling machine ( 200.000) Salvage Value 3% Gains Tax Working capital 5% ( 30.000) Financing Activities: Borrowed Funds 75.000 Principal Repayment Net Cash Flow (Actual Dollars) ( 155.000) PW (18%) = IRR = PW (18%)- IRR = Interest Rate 6% End of Year Beginning Balance Amount Payment Interest Payment Principal Payment Ending Balance 1 2 3 4 5 QUESTION 3 Andreas & Giorgos Machine Shop is evaluating the proposed acquisition of a new milling machine. The milling machine costs 175,000, and it would cost another 25,000 to modify it for special use by the company. To finance this investment, the Company is to secure a loan of the order of 75,000 from a local bank at an interest rate of 6%. The rest will be invested by the Company's own equity. The milling machine has an estimated service life of ten years, with a zero-salvage value. The milling machine will be depreciated by the straight-line method. 1 Page With this milling machine, the company will be able to generate additional annual revenues of 150,000 (Year zero). These revenues are expected to rise by 6% on a year-by-year basis. However, it requires a specially trained operator to run the machine. This will entail at Year-zero values, 50,000 in annual labour, 40,000 in annual material expenses, and another 25,000 in annual overhead (power and utility) expenses. Labour cost is expected to rise by 5% annually, materials by 4% annually, and overhead by 5% annually. It also requires an investment in working capital in the amount of 30,000, which will be recovered in full at the end of year ten with an inflation rate of 5%. The marginal tax rate is of the order of 23%. In summary: Project Nature: Purchase of a new milling machine Financial Data: o Investment activities: Capital expenditure (milling machine): 200,000. Seventy-five thousand euros (75,000) securing a loan with an interest rate of 6%. The rest by own equity. Project life: 10 years Salvage value: 0 Investment in working capital: 30,000, which will be recovered in full at the end of year 10 with an inflation rate of 5%. Operating activities: Annual operating revenue (YO): 175,000 Annual operating expenses: Labour (YO): 50,000, increasing by 5%, each year thereafter year zero. Materials (YO): 40,000 increasing by 4%, each year thereafter year zero. Overhead (YO): 25,000 increasing by 5%, each year thereafter year zero. Accounting Data: O Depreciation method: ten year straight-line Income tax rate; 23% MARR after tax: 18% O O Determine: a) The year-by-year depreciation allowances, [5 marks] b) The loan structure (15 marks) c) The year-by-year cash flow for the project at a 23% marginal tax rate, [20 marks] d) The net present worth of the project at the company's MARR of 18% (after tax) and the project IRR. [10 marks] Income Statement End of Year Inflation Rate 0 1 2 3 4 5 6 7 8 9 10 Revenue 6% Expenses: Labor 5% Materials 4% Overhead 5% Debt Interest Depreciation Taxable income Income Taxes (23%) Net Income Cash Flow Statement 0 11|2| 34 6 7 8 9 10 8 Operating Activities: Net Income Depreciation Investment Activities: Milling machine ( 200.000) Salvage Value 3% Gains Tax Working capital 5% ( 30.000) Financing Activities: Borrowed Funds 75.000 Principal Repayment Net Cash Flow (Actual Dollars) ( 155.000) PW (18%) = IRR = PW (18%)- IRR = Interest Rate 6% End of Year Beginning Balance Amount Payment Interest Payment Principal Payment Ending Balance 1 2 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts