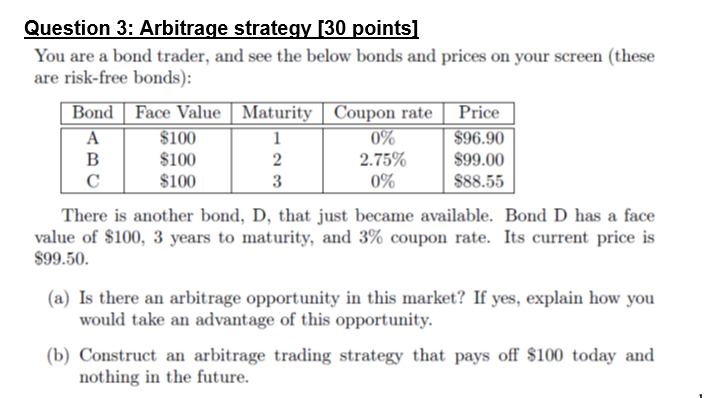

Question: Question 3: Arbitrage strategy (30 points) You are a bond trader, and see the below bonds and prices on your screen (these are risk-free bonds):

Question 3: Arbitrage strategy (30 points) You are a bond trader, and see the below bonds and prices on your screen (these are risk-free bonds): Bond Face Value Maturity Coupon rate Price A $100 1 0% $96.90 B $100 2 2.75% $99.00 $100 3 0% $88.55 There is another bond, D, that just became available. Bond D has a face value of $100, 3 years to maturity, and 3% coupon rate. Its current price is $99.50 (a) Is there an arbitrage opportunity in this market? If yes, explain how you would take an advantage of this opportunity. (b) Construct an arbitrage trading strategy that pays off $100 today and nothing in the future

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock