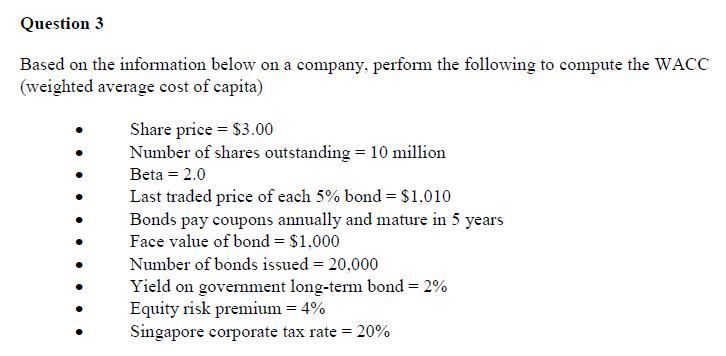

Question: Question 3 Based on the information below on a company, perform the following to compute the WACC (weighted average cost of capita) Share price =

Question 3 Based on the information below on a company, perform the following to compute the WACC (weighted average cost of capita) Share price = $3.00 Number of shares outstanding = 10 million Beta = 2.0 Last traded price of each 5% bond = $1,010 Bonds pay coupons annually and mature in 5 years Face value of bond = $1,000 Number of bonds issued = 20,000 Yield on government long-term bond = 2% Equity risk premium = 4% Singapore corporate tax rate = 20% (a) Determine the cost of equity (3 marks) (6) Determine the cost of debt (3 marks) (c) Determine the WACC (4 marks) The management of the above company wishes to raise their capital by $10 million. They are considering using debt or equity. (d) In your own words, appraise how the management should raise the capital of $10 million - through equity or debt. Evaluate both equity and debt, state the assumptions of the situation and explain your proposal. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts