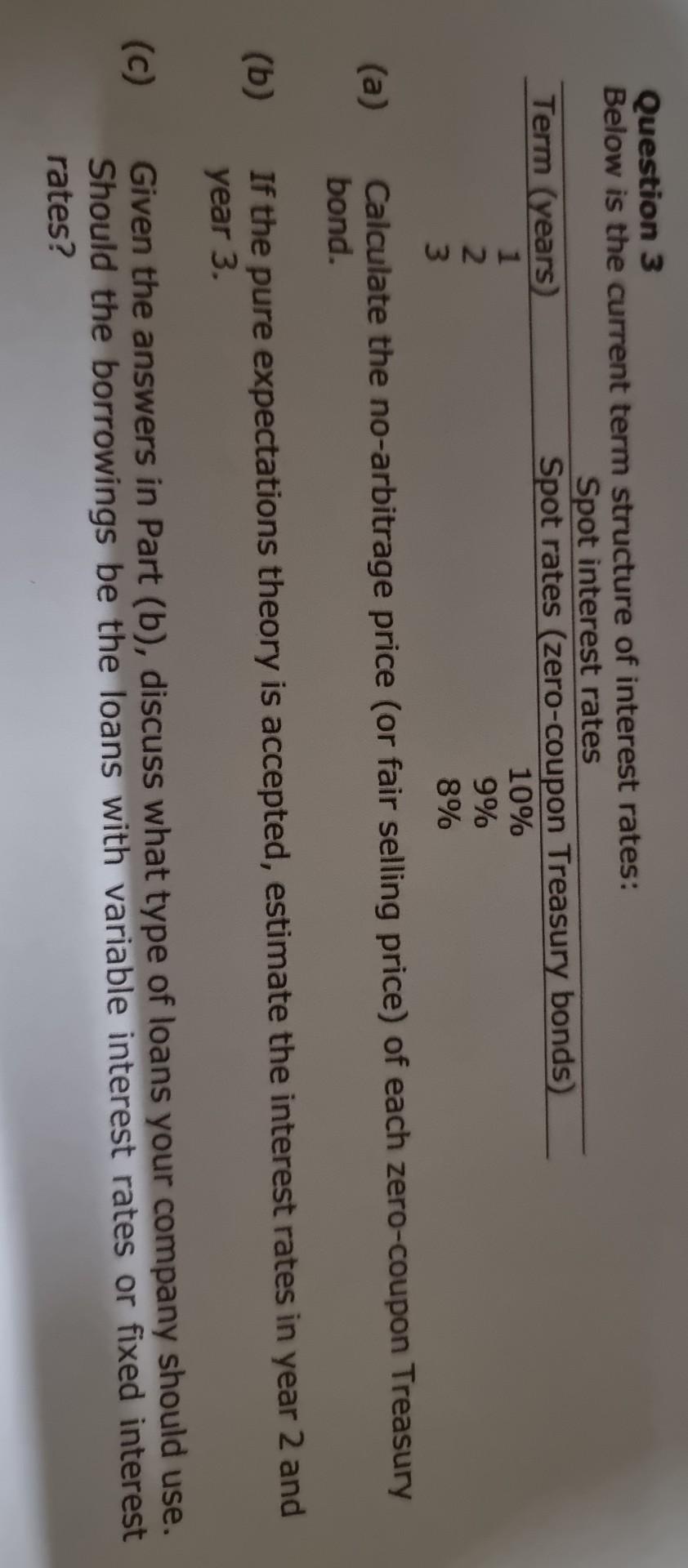

Question: Question 3 Below is the current term structure of interest rates: Spot interest rates Term (years) Spot rates (zero-coupon Treasury bonds) 1 10% 2 9%

Question 3 Below is the current term structure of interest rates: Spot interest rates Term (years) Spot rates (zero-coupon Treasury bonds) 1 10% 2 9% 3 8% (a) Calculate the no-arbitrage price (or fair selling price) of each zero-coupon Treasury bond. (b) If the pure expectations theory is accepted, estimate the interest rates in year 2 and year 3. (C) Given the answers in Part (b), discuss what type of loans your company should use. Should the borrowings be the loans with variable interest rates or fixed interest rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts