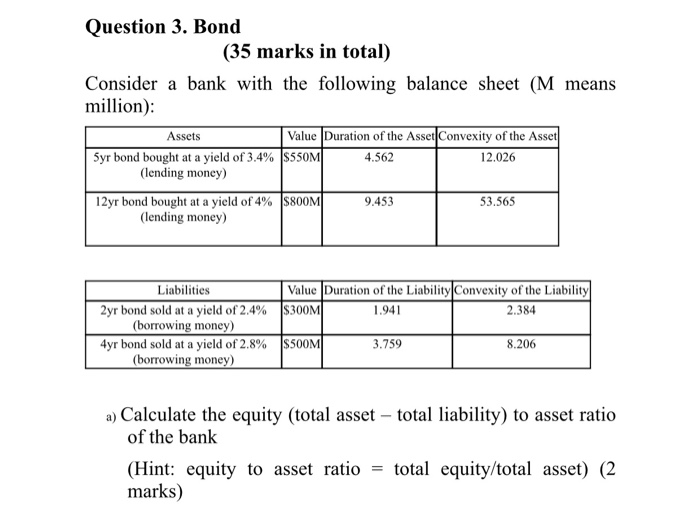

Question: Question 3. Bond (35 marks in total) Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity

Question 3. Bond (35 marks in total) Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset Syr bond bought at a yield of 3.4% $550M | 12.026 (lending money) 12yr bond bought at a yield of 4% $800M| 9.453 53.565 (lending money) 4.562 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4% $300M 1.941 2.384 (borrowing money) 4yr bond sold at a yield of 2.8% $500M 3.759 8.206 (borrowing money) a) Calculate the equity (total asset total liability) to asset ratio of the bank (Hint: equity to asset ratio = total equity/total asset) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts