Question: QUESTION 3 - CAPITAL RATIONING AND RELEVANT CASH FLOWS Basril plc is reviewing investment proposals that have been submitted by divisional managers. The investment funds

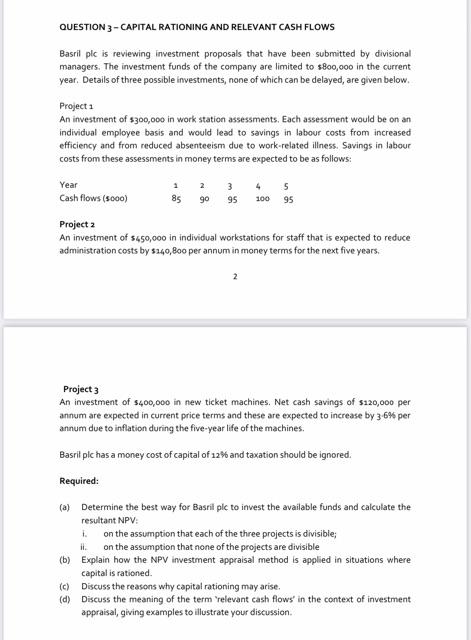

QUESTION 3 - CAPITAL RATIONING AND RELEVANT CASH FLOWS Basril plc is reviewing investment proposals that have been submitted by divisional managers. The investment funds of the company are limited to $800,000 in the current year. Details of three possible investments, none of which can be delayed, are given below. Project 1 An investment of $300,000 in work station assessments. Each assessment would be on an individual employee basis and would lead to savings in labour costs from increased efficiency and from reduced absenteeism due to work-related illness. Savings in labour costs from these assessments in money terms are expected to be as follows: Year Cash flows (5000) 1 2 3 4 5 85 90 95 100 95 Project 2 An investment of $450,000 in individual workstations for staff that is expected to reduce administration costs by $340,800 per annum in money terms for the next five years. Project 3 An investment of $400,000 in new ticket machines. Net cash savings of $120,000 per annum are expected in current price terms and these are expected to increase by 3-6% per annum due to inflation during the five-year life of the machines. Basrit pic has a money cost of capital of 12% and taxation should be ignored. Required: (a) Determine the best way for Basril ple to invest the available funds and calculate the resultant NPV: 1. on the assumption that each of the three projects is divisible; on the assumption that none of the projects are divisible (b) Explain how the NPV investment appraisal method is applied in situations where capital is rationed (c) Discuss the reasons why capital rationing may arise. (d) Discuss the meaning of the term "relevant cash flows' in the context of investment appraisal, giving examples to illustrate your discussion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts