Question: QUESTION 3 Carefully read the information below. As with other decisions, the make-versus-buy decision involves both quantitative and qualitative analysis. The quantitative component requires cost

QUESTION 3

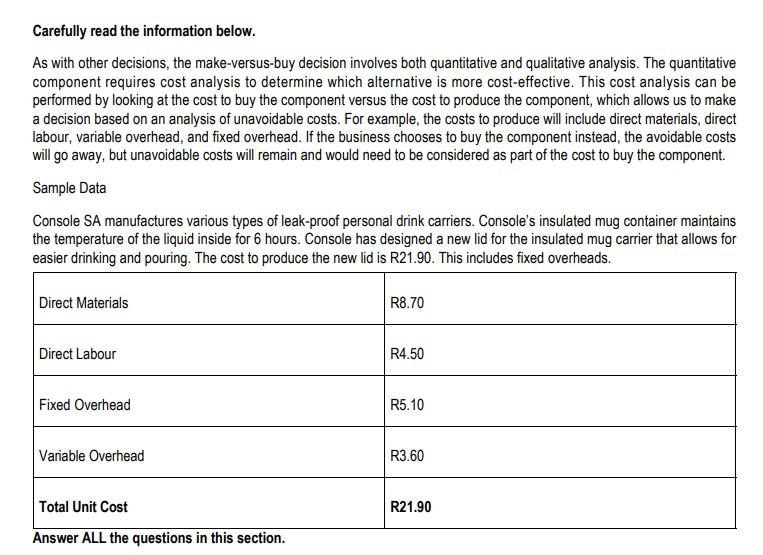

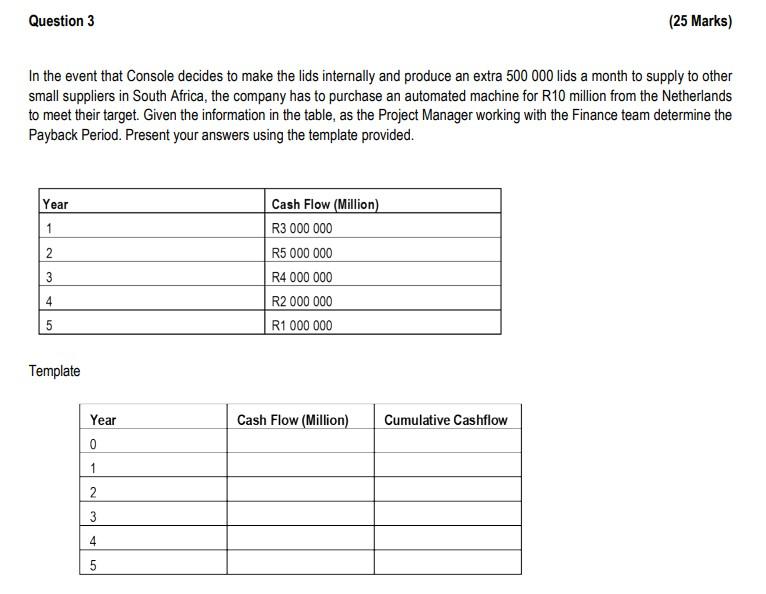

Carefully read the information below. As with other decisions, the make-versus-buy decision involves both quantitative and qualitative analysis. The quantitative component requires cost analysis to determine which alternative is more cost-effective. This cost analysis can be performed by looking at the cost to buy the component versus the cost to produce the component, which allows us to make a decision based on an analysis of unavoidable costs. For example, the costs to produce will include direct materials, direct labour, variable overhead, and fixed overhead. If the business chooses to buy the component instead, the avoidable costs will go away, but unavoidable costs will remain and would need to be considered as part of the cost to buy the component. Sample Data Console SA manufactures various types of leak-proof personal drink carriers. Console's insulated mug container maintains the temperature of the liquid inside for 6 hours. Console has designed a new lid for the insulated mug carrier that allows for easier drinking and pouring. The cost to produce the new lid is R21.90. This includes fixed overheads. Direct Materials R8.70 Direct Labour R4.50 Fixed Overhead R5.10 Variable Overhead R3.60 Total Unit Cost R21.90 Answer ALL the questions in this section. Question 3 (25 Marks) In the event that Console decides to make the lids internally and produce an extra 500 000 lids a month to supply to other small suppliers in South Africa, the company has to purchase an automated machine for R10 million from the Netherlands to meet their target. Given the information in the table, as the Project Manager working with the Finance team determine the Payback Period. Present your answers using the template provided. Year 1 2 Cash Flow (Million) R3 000 000 R5 000 000 R4 000 000 R2 000 000 R1 000 000 3 4 5 Template Year Cash Flow (Million) Cumulative Cashflow 0 1 2. 2 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts