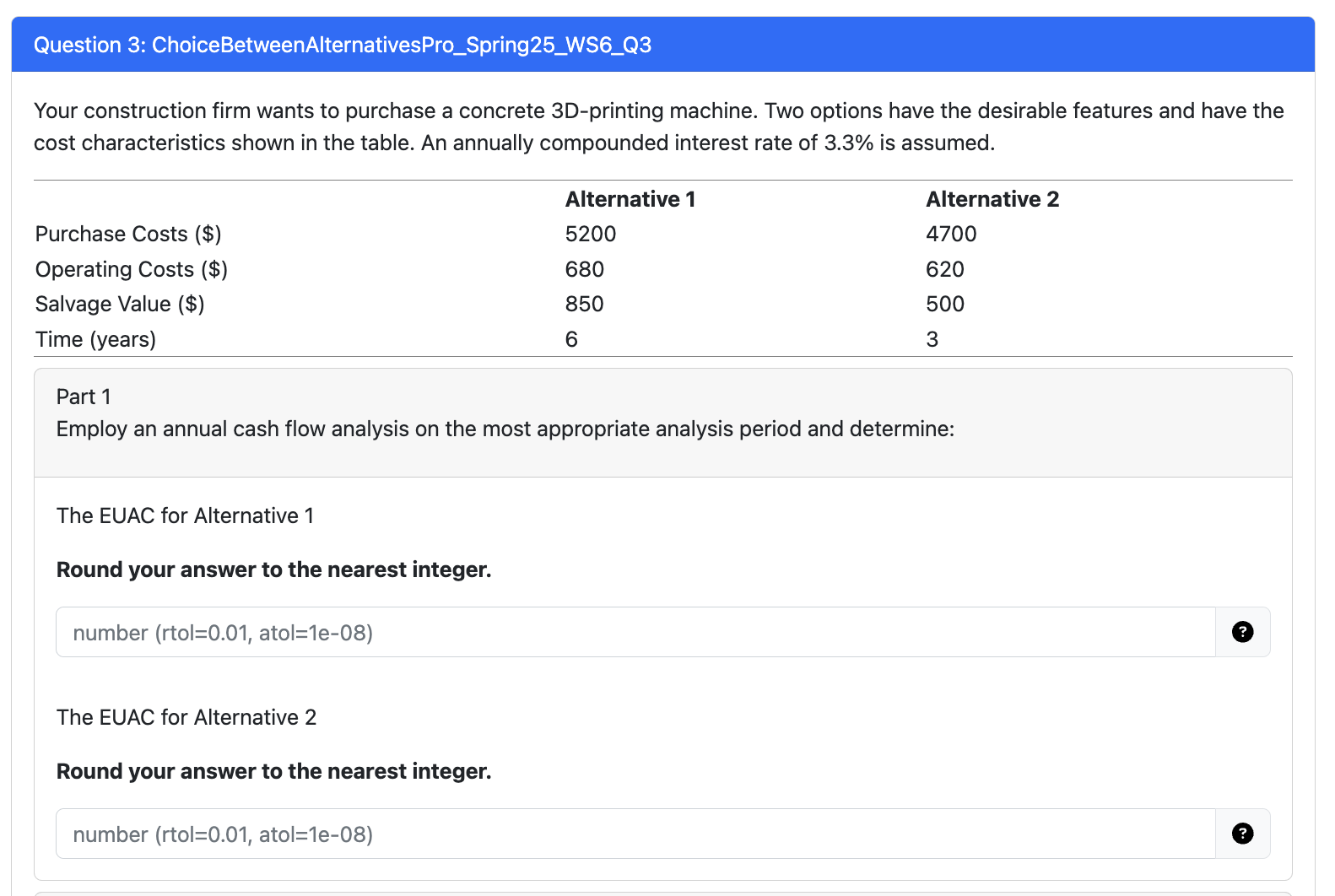

Question: Question 3 : ChoiceBetweenAlternativesPro _ Spring 2 5 _ WS 6 _ Q 3 Your construction firm wants to purchase a concrete 3 D -

Question : ChoiceBetweenAlternativesProSpringWSQ

Your construction firm wants to purchase a concrete Dprinting machine. Two options have the desirable features and have the cost characteristics shown in the table. An annually compounded interest rate of is assumed.

Part

Employ an annual cash flow analysis on the most appropriate analysis period and determine:

The EUAC for Alternative

Round your answer to the nearest integer.

number rtol atole

The EUAC for Alternative

Round your answer to the nearest integer.

number rtol atol mathrme Part

Employ the present worth analysis with a fixed analysis period of years. Consider the following market values for alternative :

$ after year,

$ after years,

$ after years,

$ after years,

$ after years.

Determine the following Hint: pick the appropriate market value to add at the end of the fixed period analysis period given:

The present worth cost for Alternative

Round your answer to the nearest integer.

The present worth cost for Alternative

Round your answer to the nearest integer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock