Question: Question 3 (CLO 1.1-1.6; 2.2, 2.4_ 2 points): When auditing sales and collection cycle, sales could be overstated or understated. Required: 1. Analyze the circumstances

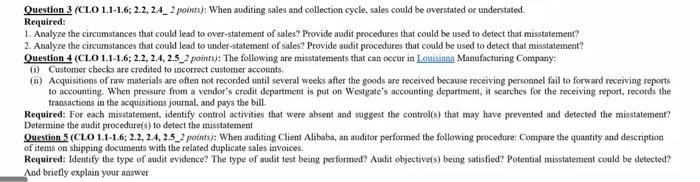

Question 3 (CLO 1.1-1.6; 2.2, 2.4_ 2 points): When auditing sales and collection cycle, sales could be overstated or understated. Required: 1. Analyze the circumstances that could lead to over-statement of sales? Provide audit procedures that could be used to detect that misstatement? 2. Analyze the circumstances that could lead to under-statement of sales? Provide audit procedures that could be used to detect that misstatement? Question 4 (CLO 1.1-1.6; 2.2, 2.4, 2.5_2 points): The following are misstatements that can occur in Louisiana Manufacturing Company: (1) Customer checks are credited to incorrect customer accounts. (m) Acquisitions of raw materials are often not recorded until several weeks after the goods are received because receiving personnel fail to forward receiving reports to accounting. When pressure from a vendor's credit department is put on Westgate's accounting department, it searches for the receiving report, records the transactions in the acquisitions journal, and pays the bill. Required: For each misstatement, identify control activities that were absent and suggest the control(s) that may have prevented and detected the misstatement? Determine the audit procedure(s) to detect the misstatement Question 5 (CLO 1.1-16; 2.2, 2.4, 2.5_2 points): When auditing Client Alibaba, an auditor performed the following procedure: Compare the quantity and description of items on shipping documents with the related duplicate sales invoices. Required: Identify the type of audit evidence? The type of audit test being performed? Audit objective(s) being satisfied? Potential misstatement could be detected? And briefly explain your answer Question 3 (CLO 1.1-1.6; 2.2, 2.4_ 2 points): When auditing sales and collection cycle, sales could be overstated or understated. Required: 1. Analyze the circumstances that could lead to over-statement of sales? Provide audit procedures that could be used to detect that misstatement? 2. Analyze the circumstances that could lead to under-statement of sales? Provide audit procedures that could be used to detect that misstatement? Question 4 (CLO 1.1-1.6; 2.2, 2.4, 2.5_2 points): The following are misstatements that can occur in Louisiana Manufacturing Company: (1) Customer checks are credited to incorrect customer accounts. (m) Acquisitions of raw materials are often not recorded until several weeks after the goods are received because receiving personnel fail to forward receiving reports to accounting. When pressure from a vendor's credit department is put on Westgate's accounting department, it searches for the receiving report, records the transactions in the acquisitions journal, and pays the bill. Required: For each misstatement, identify control activities that were absent and suggest the control(s) that may have prevented and detected the misstatement? Determine the audit procedure(s) to detect the misstatement Question 5 (CLO 1.1-16; 2.2, 2.4, 2.5_2 points): When auditing Client Alibaba, an auditor performed the following procedure: Compare the quantity and description of items on shipping documents with the related duplicate sales invoices. Required: Identify the type of audit evidence? The type of audit test being performed? Audit objective(s) being satisfied? Potential misstatement could be detected? And briefly explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts