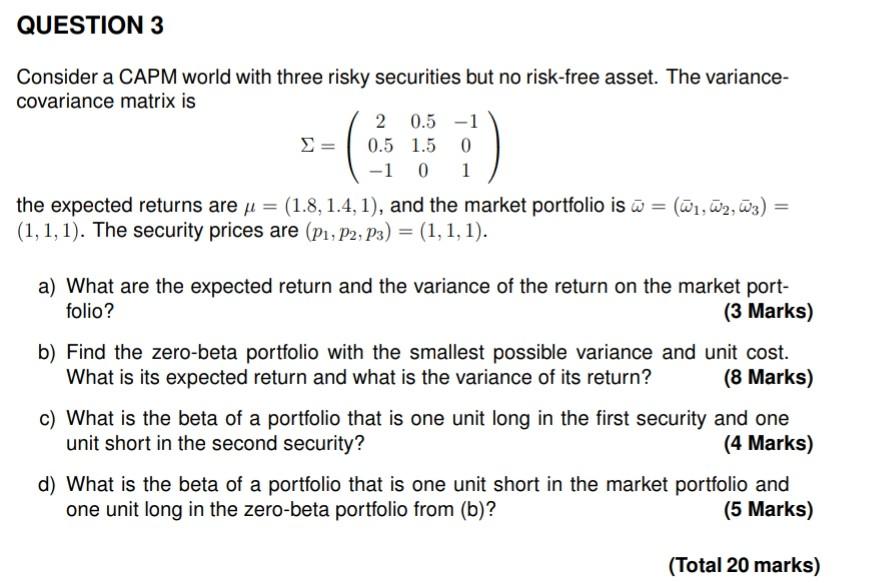

Question: QUESTION 3 Consider a CAPM world with three risky securities but no risk-free asset. The variance- covariance matrix is 2 0.5-1 = 0.5 1.5 0

QUESTION 3 Consider a CAPM world with three risky securities but no risk-free asset. The variance- covariance matrix is 2 0.5-1 = 0.5 1.5 0 -1 0 1 the expected returns are = (1.8, 1.4,1), and the market portfolio is w = (W1,W2, W3) = (1,1,1). The security prices are (P1, P2, P3) = (1,1,1). a) What are the expected return and the variance of the return on the market port- folio? (3 Marks) b) Find the zero-beta portfolio with the smallest possible variance and unit cost. What is its expected return and what is the variance of its return? (8 Marks) c) What is the beta of a portfolio that is one unit long in the first security and one unit short in the second security? (4 Marks) d) What is the beta of a portfolio that is one unit short in the market portfolio and one unit long in the zero-beta portfolio from (b)? (5 Marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts