Question: Question 3 Do Well Pic is preparing to launch a new product in a new market which is outside its current business operations. The company

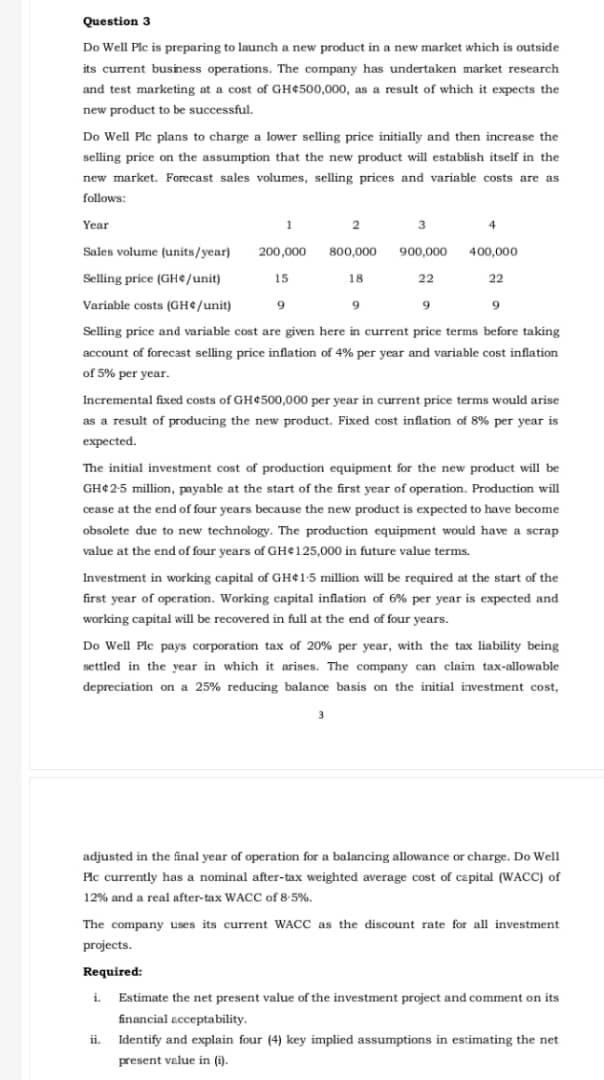

Question 3 Do Well Pic is preparing to launch a new product in a new market which is outside its current business operations. The company has undertaken market research and test marketing at a cost of GH4500,000, as a result of which it expects the new product to be successful. Do Well Ple plans to charge a lower selling price initially and then increase the selling price on the assumption that the new product will establish itself in the new market. Forecast sales volumes, selling prices and variable costs are as follows: Selling price and variable cost are given here in current price terms before taking account of forecast selling price inflation of 4% per year and variable cost inflation of 5% per year. Incremental fixed costs of GH 4500,000 per year in current price terms would arise as a result of producing the new product. Fixed cost inflation of 8% per year is expected. The initial investment cost of production equipment for the new product will be GH\$2-5 million, payable at the start of the first year of operation. Production will cease at the end of four years because the new product is expected to have become obsolete due to new technology. The production equipment would have a scrap value at the end of four years of GHe125,000 in future value terms. Investment in working capital of GH\$1.5 million will be required at the start of the first year of operation. Working eapital inflation of 6% per year is expected and working capital will be recovered in full at the end of four years. Do Well Ple pays corporation tax of 20% per year, with the tax liability being settled in the year in which it arises. The company can clain tax-allowable depreciation on a 25% reducing balance basis on the initial investment cost, 3 adjusted in the final year of operation for a balancing allowance or charge. Do Well Ple currently has a nominal after-tax weighted average cost of capital (WACC) of 12% and a real after-tax WACC of 8.5%. The company uses its current WACC as the discount rate for all investment projects. Required: i. Estimate the net present value of the investment project and comment on its financial scceptability. ii. Identify and explain four (4) key implied assumptions in estimating the net present value in (i)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts