Question: Question One (20 marks) Ellen Sybille PLC is preparing to launch a new product in a new market which is outside i ts current business

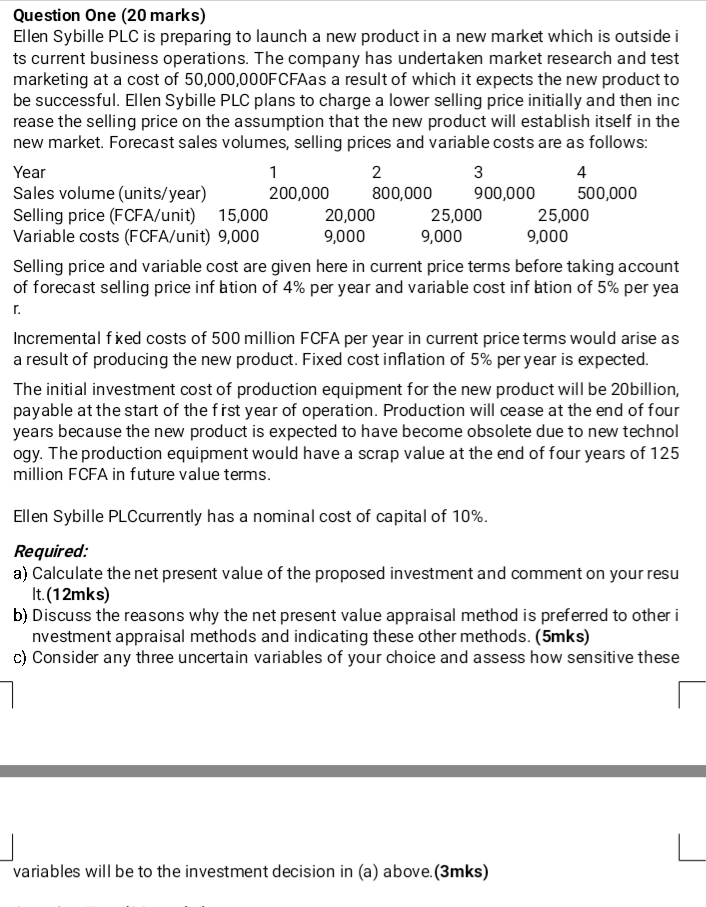

Question One (20 marks) Ellen Sybille PLC is preparing to launch a new product in a new market which is outside i ts current business operations. The company has undertaken market research and test marketing at a cost of 50,000,000FCFAas a result of which it expects the new product to be successful. Ellen Sybille PLC plans to charge a lower selling price initially and then inc rease the selling price on the assumption that the new product will establish itself in the new market. Forecast sales volumes, selling prices and variable costs are as follows: Year 1 2 3 4 Sales volume (units/year) 200,000 800,000 900,000 500,000 Selling price (FCFA/unit) 15,000 20,000 25,000 25,000 Variable costs (FCFA/unit) 9,000 9,000 9,000 9,000 Selling price and variable cost are given here in current price terms before taking account of forecast selling price inf ation of 4% per year and variable cost inf ation of 5% per yea r. Incremental fied costs of 500 million FCFA per year in current price terms would arise as a result of producing the new product. Fixed cost inflation of 5% per year is expected. The initial investment cost of production equipment for the new product will be 20billion, payable at the start of the first year of operation. Production will cease at the end of four years because the new product is expected to have become obsolete due to new technol ogy. The production equipment would have a scrap value at the end of four years of 125 million FCFA in future value terms. Ellen Sybille PLCcurrently has a nominal cost of capital of 10%. Required: a) Calculate the net present value of the proposed investment and comment on your resu It (12mks) b) Discuss the reasons why the net present value appraisal method is preferred to other i nvestment appraisal methods and indicating these other methods. (Smks) c) Consider any three uncertain variables of your choice and assess how sensitive these 7 variables will be to the investment decision in (a) above.(3mks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts