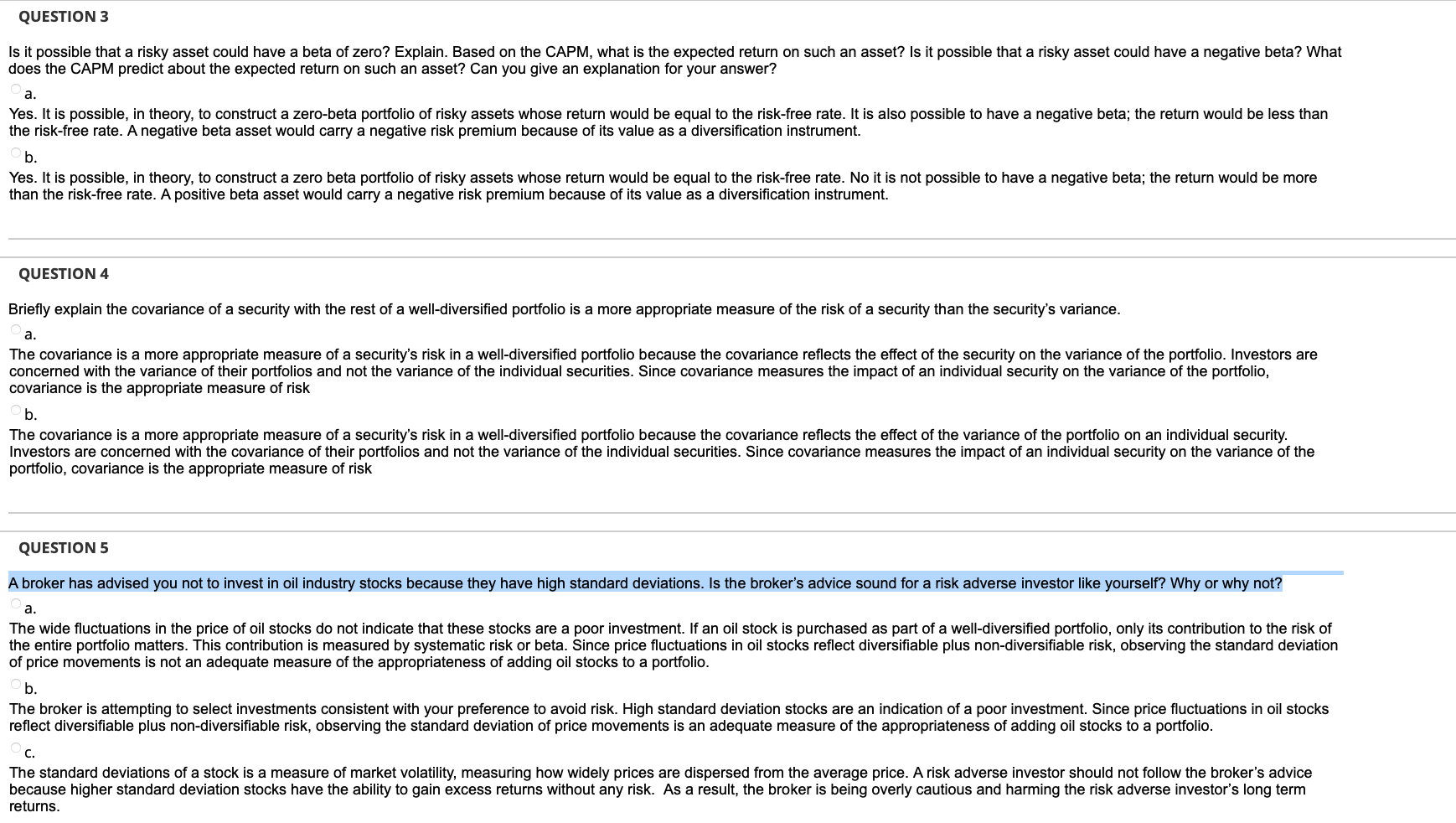

Question: QUESTION 3 does the CAPM predict about the expected return on such an asset? Can you give an explanation for your answer? a . the

QUESTION

does the CAPM predict about the expected return on such an asset? Can you give an explanation for your answer?

a

the riskfree rate. A negative beta asset would carry a negative risk premium because of its value as a diversification instrument.

b

than the riskfree rate. A positive beta asset would carry a negative risk premium because of its value as a diversification instrument.

QUESTION

Briefly explain the covariance of a security with the rest of a welldiversified portfolio is a more appropriate measure of the risk of a security than the securitys variance.

a

covariance is the appropriate measure of risk

b

portfolio, covariance is the appropriate measure of risk

QUESTION

a

of price movements is not an adequate measure of the appropriateness of adding oil stocks to a portfolio.

b

reflect diversifiable plus nondiversifiable risk, observing the standard deviation of price movements is an adequate measure of the appropriateness of adding oil stocks to a portfolio.

c

returns.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock