Question: Question 3 E You have been tasked with calculating the results of these four independent scenarios. Not yet answered Marked out of 30.00 Flag

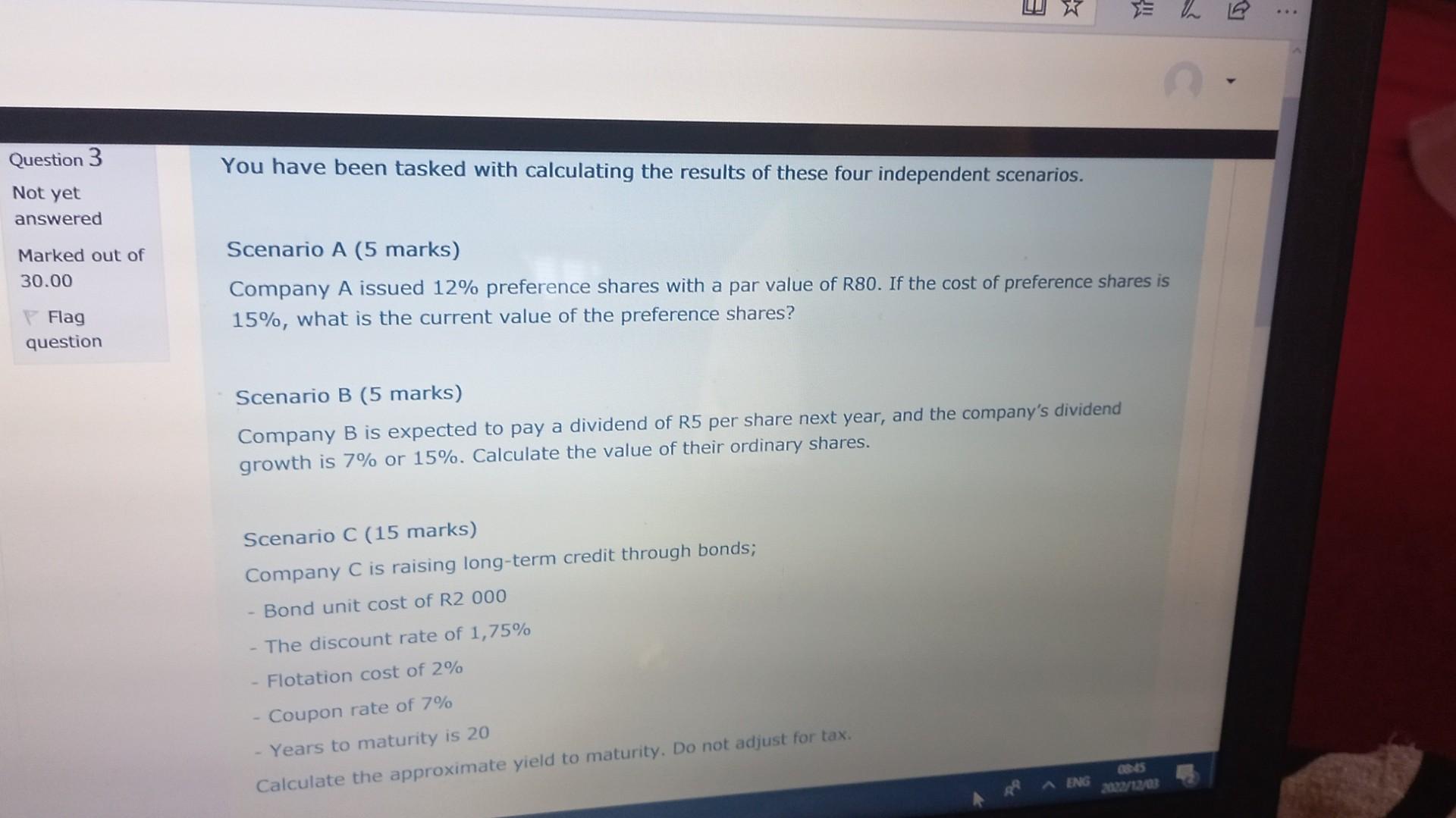

Question 3 E You have been tasked with calculating the results of these four independent scenarios. Not yet answered Marked out of 30.00 Flag question Scenario A (5 marks) Company A issued 12% preference shares with a par value of R80. If the cost of preference shares is 15%, what is the current value of the preference shares? Scenario B (5 marks) Company B is expected to pay a dividend of R5 per share next year, and the company's dividend growth is 7% or 15%. Calculate the value of their ordinary shares. Scenario C (15 marks) Company C is raising long-term credit through bonds; Bond unit cost of R2 000 The discount rate of 1,75% - Flotation cost of 2% Coupon rate of 7% Years to maturity is 20 Calculate the approximate yield to maturity. Do not adjust for tax. 08:45 A ENG 2022/12/03 L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts