Question: Question #3: Expectation Theory [16 Points] The following table shows the current and expected one-year interest rates in following four years. oi 112 2ize

![Question #3: Expectation Theory [16 Points] The following table shows the current](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/03/65f83fff041e7_12665f83ffed0828.jpg)

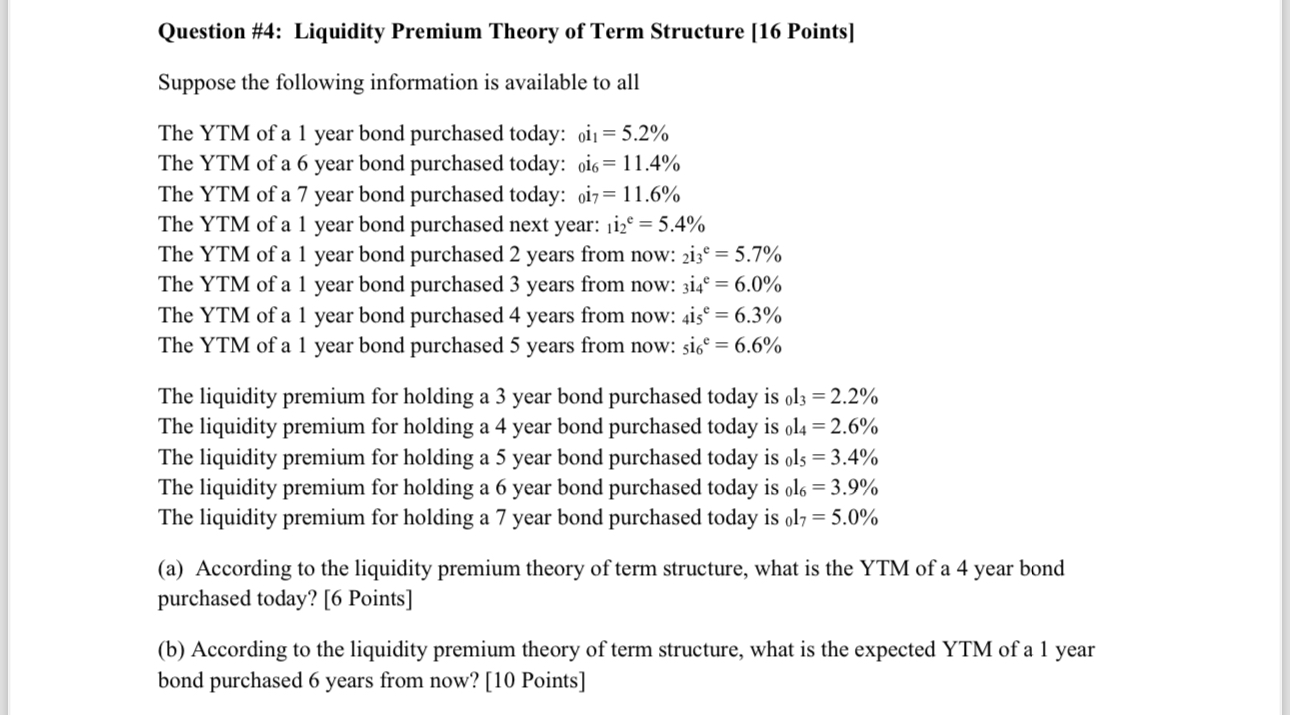

Question #3: Expectation Theory [16 Points] The following table shows the current and expected one-year interest rates in following four years. oi 112 2ize 314 4i5e 5.8% 5.5% 5.3% 5.0% 4.7% (a) Estimate the YTM on bonds of 2, 3, 4 and 5 years to maturity and graphically illustrate the yield curve under the expectations hypothesis. [8 Points] (b) Calculate the price of a discount bond that is purchased in year 3 that promises to pay $1000 in year 5. Hint: You must first calculate the YTM of a 2 year bond that is purchased in year 3, 3i5. Solve for: 31 = [8 Points] 2 Question #4: Liquidity Premium Theory of Term Structure [16 Points] Suppose the following information is available to all The YTM of a 1 year bond purchased today: 0i1 = 5.2% The YTM of a 6 year bond purchased today: 016 = 11.4% The YTM of a 7 year bond purchased today: 017 = 11.6% The YTM of a 1 year bond purchased next year: 112 = 5.4% The YTM of a 1 year bond purchased 2 years from now: 213 = 5.7% The YTM of a 1 year bond purchased 3 years from now: 314 = 6.0% The YTM of a 1 year bond purchased 4 years from now: 415 = 6.3% The YTM of a 1 year bond purchased 5 years from now: si6 = 6.6% The liquidity premium for holding a 3 year bond purchased today is 0l3 = 2.2% The liquidity premium for holding a 4 year bond purchased today is 014 = 2.6% The liquidity premium for holding a 5 year bond purchased today is ols = 3.4% The liquidity premium for holding a 6 year bond purchased today is 016 = 3.9% The liquidity premium for holding a 7 year bond purchased today is 017 = 5.0% (a) According to the liquidity premium theory of term structure, what is the YTM of a 4 year bond purchased today? [6 Points] (b) According to the liquidity premium theory of term structure, what is the expected YTM of a 1 year bond purchased 6 years from now? [10 Points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts