Question: Question 3 Following table presents expected return on two stocks under two market returns. Market return Stock A Stock B 6% 3% 4.5% 21% 34%

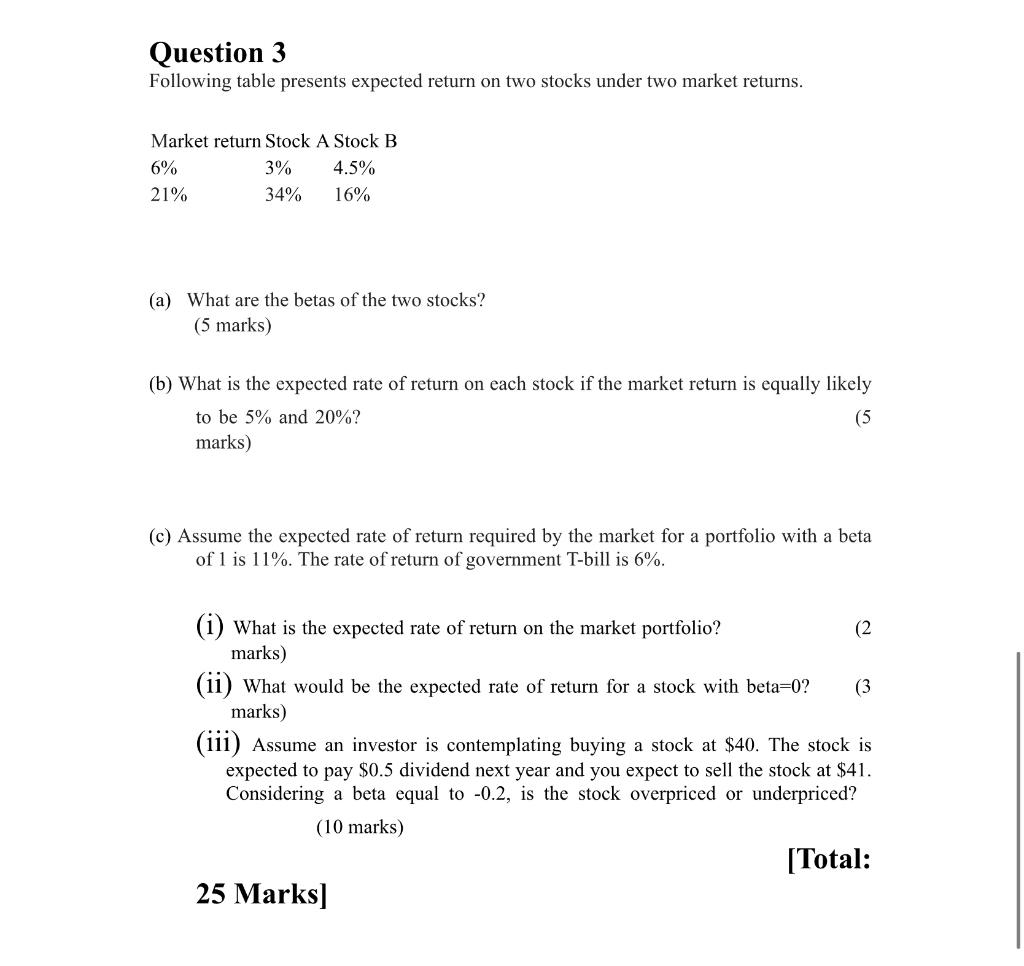

Question 3 Following table presents expected return on two stocks under two market returns. Market return Stock A Stock B 6% 3% 4.5% 21% 34% 16% (a) What are the betas of the two stocks? (5 marks) (b) What is the expected rate of return on each stock if the market return is equally likely to be 5% and 20%? (5 marks) (c) Assume the expected rate of return required by the market for a portfolio with a beta of 1 is 11%. The rate of return of government T-bill is 6%. (3 (i) What is the expected rate of return on the market portfolio? (2 marks) (ii) What would be the expected rate of return for a stock with beta=0? marks) (iii) Assume an investor is contemplating buying a stock at $40. The stock is expected to pay $0.5 dividend next year and you expect to sell the stock at $41. Considering a beta equal to -0.2, is the stock overpriced or underpriced? (10 marks) [Total: 25 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts