Question: Question 3 Hamilton Ltd. is in the consumer electronics business and distributes electronic items to shops and DIY centres. The company has been trading

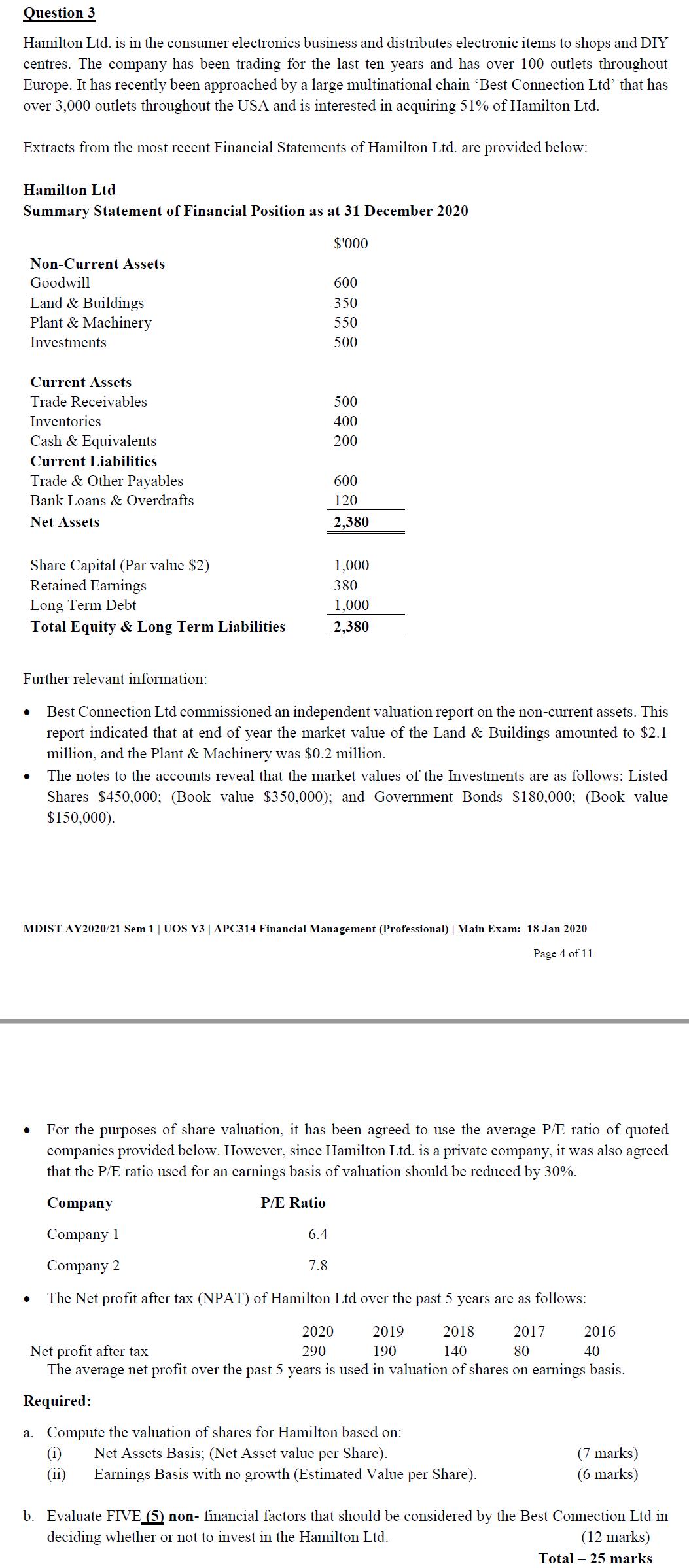

Question 3 Hamilton Ltd. is in the consumer electronics business and distributes electronic items to shops and DIY centres. The company has been trading for the last ten years and has over 100 outlets throughout Europe. It has recently been approached by a large multinational chain Best Connection Ltd' that has over 3,000 outlets throughout the USA and is interested in acquiring 51% of Hamilton Ltd. Extracts from the most recent Financial Statements of Hamilton Ltd. are provided below: Hamilton Ltd Summary Statement of Financial Position as at 31 December 2020 $'000 Non-Current Assets Goodwill 600 Land & Buildings 350 Plant & Machinery 550 Investments 500 Current Assets Trade Receivables 500 Inventories 400 Cash & Equivalents 200 Current Liabilities Trade & Other Payables 600 Bank Loans & Overdrafts 120 Net Assets 2,380 Share Capital (Par value $2) 1,000 Retained Earnings 380 Long Term Debt 1,000 Total Equity & Long Term Liabilities 2,380 Further relevant information: Best Connection Ltd commissioned an independent valuation report on the non-current assets. This report indicated that at end of year the market value of the Land & Buildings amounted to $2.1 million, and the Plant & Machinery was $0.2 million. The notes to the accounts reveal that the market values of the Investments are as follows: Listed Shares $450,000; (Book value $350,000); and Government Bonds $180,000; (Book value $150,000). MDIST AY2020/21 Sem 1 | UOS Y3 | APC314 Financial Management (Professional) | Main Exam: 18 Jan 2020 Page 4 of 11 For the purposes of share valuation, it has been agreed to use the average P/E ratio of quoted companies provided below. However, since Hamilton Ltd. is a private company, it was also agreed that the P/E ratio used for an earnings basis of valuation should be reduced by 30%. Company P/E Ratio Company 1 6.4 7.8 Company 2 The Net profit after tax (NPAT) of Hamilton Ltd over the past 5 years are as follows: 2019 2018 2017 2016 2020 290 Net profit after tax 190 140 80 40 The average net profit over the past 5 years is used in valuation of shares on earnings basis. Required: a. Compute the valuation of shares for Hamilton based on: (1) Net Assets Basis; (Net Asset value per Share). (7 marks) (6 marks) (11) Earnings Basis with no growth (Estimated Value per Share). b. Evaluate FIVE (5) non- financial factors that should be considered by the Best Connection Ltd in deciding whether or not to invest in the Hamilton Ltd. (12 marks) Total 25 marks

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

a 1 238 million 1000 shares 2380 per share 2 290 million 5 years 58 million 58 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635ddef1c6c24_179568.pdf

180 KBs PDF File

635ddef1c6c24_179568.docx

120 KBs Word File