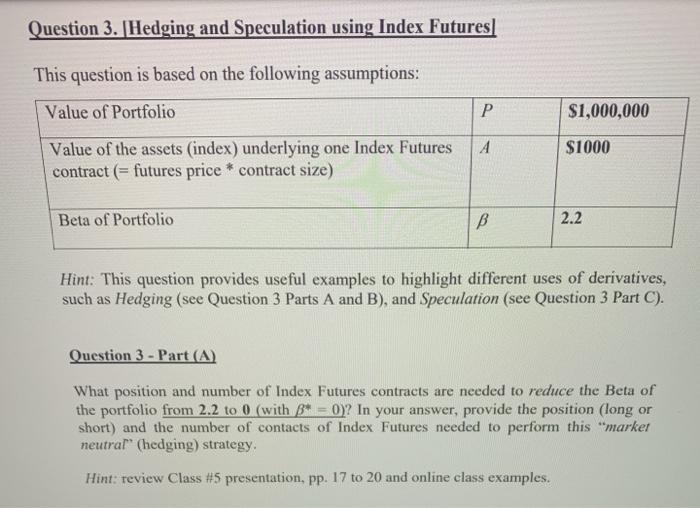

Question: Question 3. Hedging and Speculation using Index Futures This question is based on the following assumptions: Value of Portfolio $1,000,000 A $1000 Value of the

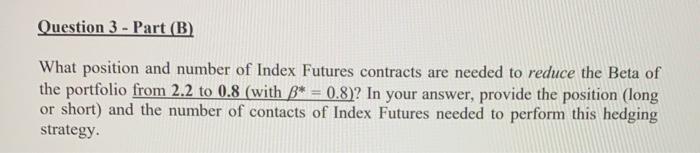

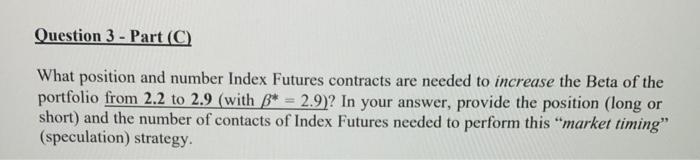

Question 3. Hedging and Speculation using Index Futures This question is based on the following assumptions: Value of Portfolio $1,000,000 A $1000 Value of the assets (index) underlying one Index Futures contract (= futures price * contract size) Beta of Portfolio B 2.2 Hint: This question provides useful examples to highlight different uses of derivatives, such as Hedging (see Question 3 Parts A and B), and Speculation (see Question 3 Part C). Question 3 - Part (A) What position and number of Index Futures contracts are needed to reduce the Beta of the portfolio from 2.2 to 0 (with 8* = 0)? In your answer, provide the position (long or short) and the number of contacts of Index Futures needed to perform this "market neutral" (hedging) strategy. Hint: review Class #5 presentation, pp. 17 to 20 and online class examples. Question 3 - Part (B) What position and number of Index Futures contracts are needed to reduce the Beta of the portfolio from 2.2 to 0.8 (with 3* = 0.8)? In your answer, provide the position (long or short) and the number of contacts of Index Futures needed to perform this hedging strategy Question 3 - Part (C) What position and number Index Futures contracts are needed to increase the Beta of the portfolio from 2.2 to 2.9 (with B* = 2.9)? In your answer, provide the position (long or short) and the number of contacts of Index Futures needed to perform this "market timing" (speculation) strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts