Question: Question 3 HomeworkAnswer in box in incorrect and theres two parts to this question Suppose you are 30 years old and would like to retire

Question 3 HomeworkAnswer in box in incorrect and theres two parts to this question

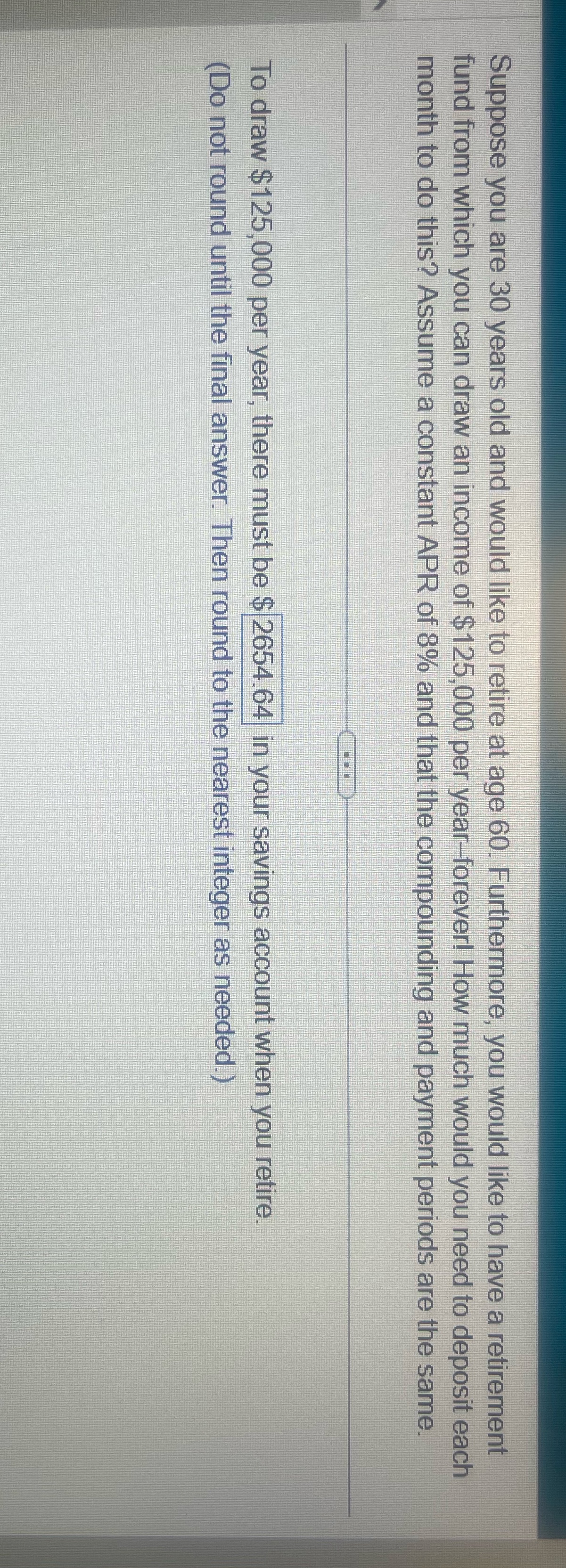

Suppose you are 30 years old and would like to retire at age 60. Furthermore, you would like to have a retirement fund from which you can draw an income of $125,000 per year-forever! How much would you need to deposit each month to do this? Assume a constant APR of 8% and that the compounding and payment periods are the same. To draw $125,000 per year, there must be $ 2654.64 in your savings account when you retire. (Do not round until the final answer. Then round to the nearest integer as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts