Question: Question 3: (Interest Rate Risk, 15 points) a) (5 points) Calculate the Macaulay's duration of a bond issued at the par (Par=$1000) with a coupon

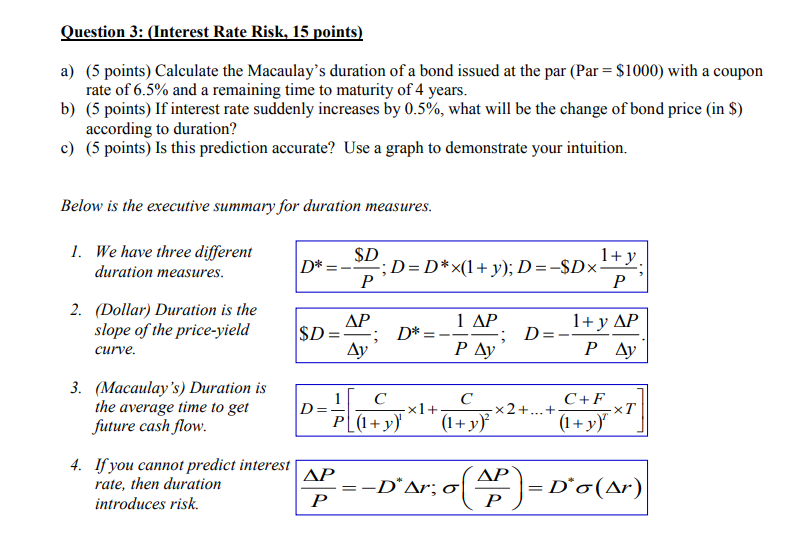

Question 3: (Interest Rate Risk, 15 points) a) (5 points) Calculate the Macaulay's duration of a bond issued at the par (Par=$1000) with a coupon rate of 6.5% and a remaining time to maturity of 4 years. b) (5 points) If interest rate suddenly increases by 0.5%, what will be the change of bond price (in $ ) according to duration? c) (5 points) Is this prediction accurate? Use a graph to demonstrate your intuition. Below is the executive summary for duration measures. 1. We have three different duration measures. D=P$D;D=D(1+y);D=$DP1+y; 2. (Dollar) Duration is the slope of the price-yield curve. $D=yP;D=P1yP;D=P1+yyP. 3. (Macaulay's) Duration is the average time to get future cash flow. D=P1[(1+y)1C1+(1+y)2C2++(1+y)TC+FT] 4. If you cannot predict interest rate, then duration introduces risk. PP=Dr;(PP)=D(r) Question 3: (Interest Rate Risk, 15 points) a) (5 points) Calculate the Macaulay's duration of a bond issued at the par (Par=$1000) with a coupon rate of 6.5% and a remaining time to maturity of 4 years. b) (5 points) If interest rate suddenly increases by 0.5%, what will be the change of bond price (in $ ) according to duration? c) (5 points) Is this prediction accurate? Use a graph to demonstrate your intuition. Below is the executive summary for duration measures. 1. We have three different duration measures. D=P$D;D=D(1+y);D=$DP1+y; 2. (Dollar) Duration is the slope of the price-yield curve. $D=yP;D=P1yP;D=P1+yyP. 3. (Macaulay's) Duration is the average time to get future cash flow. D=P1[(1+y)1C1+(1+y)2C2++(1+y)TC+FT] 4. If you cannot predict interest rate, then duration introduces risk. PP=Dr;(PP)=D(r)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts