Question: QUESTION 3 Interrogate the information provided below and answer the following questions.INFORMATIONLethabo Enterprises ( LE ) , a growing family - owned business, specialises in

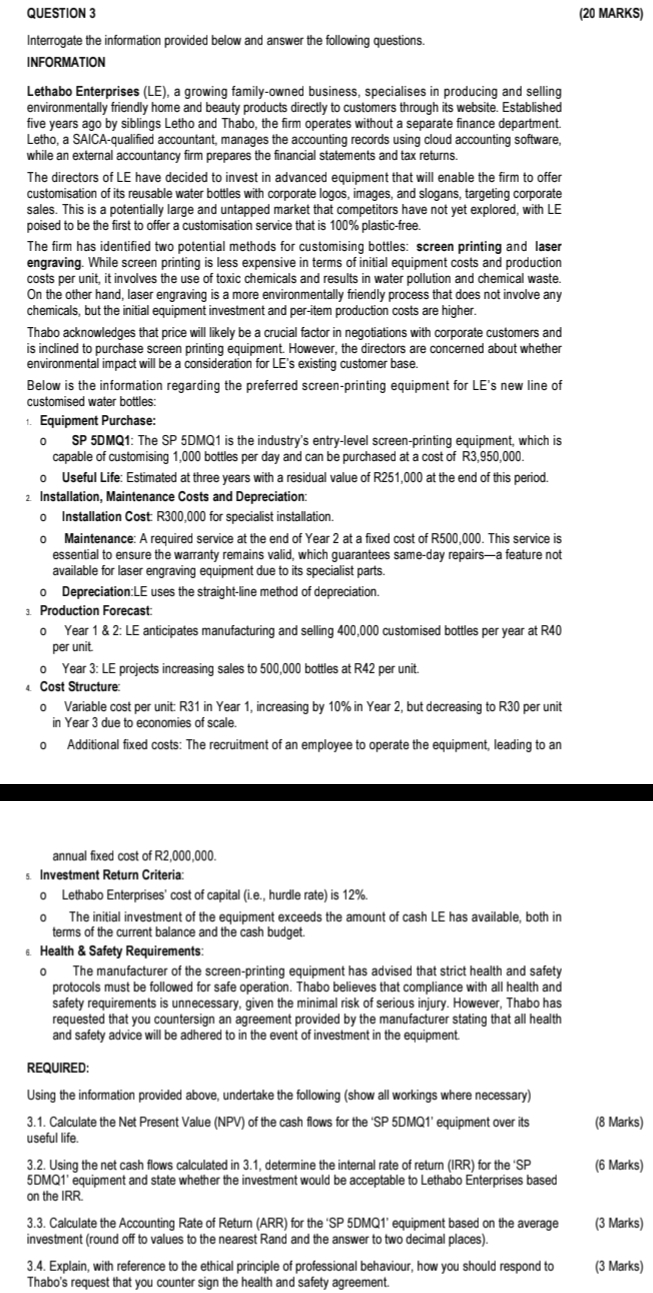

QUESTION Interrogate the information provided below and answer the following questions.INFORMATIONLethabo Enterprises LE a growing familyowned business, specialises in producing and sellingenvironmentally friendly home and beauty products directly to customers through its website. Establishedfive years ago by siblings Letho and Thabo, the firm operates without a separate finance department.Letho, a SAICAqualified accountant, manages the accounting records using doud accounting software,while an external acoountancy firm prepares the financial statements and tax returns.The directors of LEf LE have decided to invest in advanced equipment that will enable the firm to offercustomisation of its reusable water bottles with corporate logos images, and slogans, targeting corporatesales. This is a potentially large and untapped market that competitors have not yet explored, with LEpoised to be the first to offer a customisation service that is plasticfree.The firm has identified two potential methods for customising bottles: screen printing and laserengravingg. While screen printing is less expensive in terms of initial equipment costs and productioncosts per unit, it involves the use of toxic chemicals and results in water pollution and chemical waste.On the other hand, laser engraving is a more environmentally friendly process that does not involve anychemicals, but the initial equipment investment and peritem producion costs are higher.Thabo acknowledges that price will likely be a crucial factor in negotiations with corporate customers andis inclined to purchase screen pinting equipment. However, the directors are concerned about whetherenvironmental impact will be a consideration for LE's existing customer base.Below is the information regarding the preferred screenprinting equipment for LE's new line ofcustomised water bottles:L Equipment Purchase:o Useful Life: Estimated at three years with a residual value of R at the end of this period Installation, Maintenance Costs and Depreciation:oooSP DMQ: The SP DMQ is the industry's entrylevel screenprinting equipment, which iscapable of customising bottles per day and can be purchased at a cost of RoInstallation Cost R for specialist installation.Maintenance: A required service at the end of Year at a fixed cost of R This service isessential to ensure the warranty remains valid, which guarantees sameday repairsa feature notavailable for laser engraving equipment due to its specialist parts.Depreciation:LE uses the straightine method of depreciation Production ForecastYear &: LE anticipates manufacturing and selling customised bottles per year at Rper unit.o Year : LE projects increasing sales to bottles at R per unit.Cost Structure:Variable cost per unit: R in Year increasing by in Year but decreasing to R per unitin Year due to economies of scale.o Additional fixed costs: The recruitment of an employee to operate the equipment, leading to anannual fixed cost of Rs Investment Return Criteria:o Lethabo Enterprises' cost of capital Le hurdle rate is The initial investment of the equipment exceeds the am ount of cash LE has available, both interms of the current balance and the cash budget.Health & Safety Requirements:The manufacturer of the screenprinting equipment has advised that strict health and safetyprotocols must be followed for safe operation. Thabo believes that compliance with all health andsafety requirements is unnecessary, given the minimal risk of serious injury. However, Thabo hasrequested that you countersign an agreement provided by the manufacturer stating that all healthand safety advice will be adhered to in the event of investment in the equipmentREQUIRED:Using the information provided above, undertake the following show all workings where necessary Calculate the Net Present Value NPV of the cash flows for the SP DMQ equipment over itsuseful life Using the net cash flows calculated in determine the internal rate of return RR for the SPDMQ equipment and state whether the investment would be acceptable to Lethabo Enterprises basedon the IRR Calculate the Accounting Rate of Return ARR for the SP DMQ equipment based on the averageinvestment round off to values to the nearest Rand and the answer to two decimal places Explain, with reference to the ethical principle of professional behaviour, how you should respond toThabo's request that you counter sign the health and safety agreement. MARKS Marks Marks Marks Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock