Question: Question 3 - IPO - Venture Capital Financing (11 Points) Wonderland is a new venture that was financed with venture capital over three rounds. Wonderland's

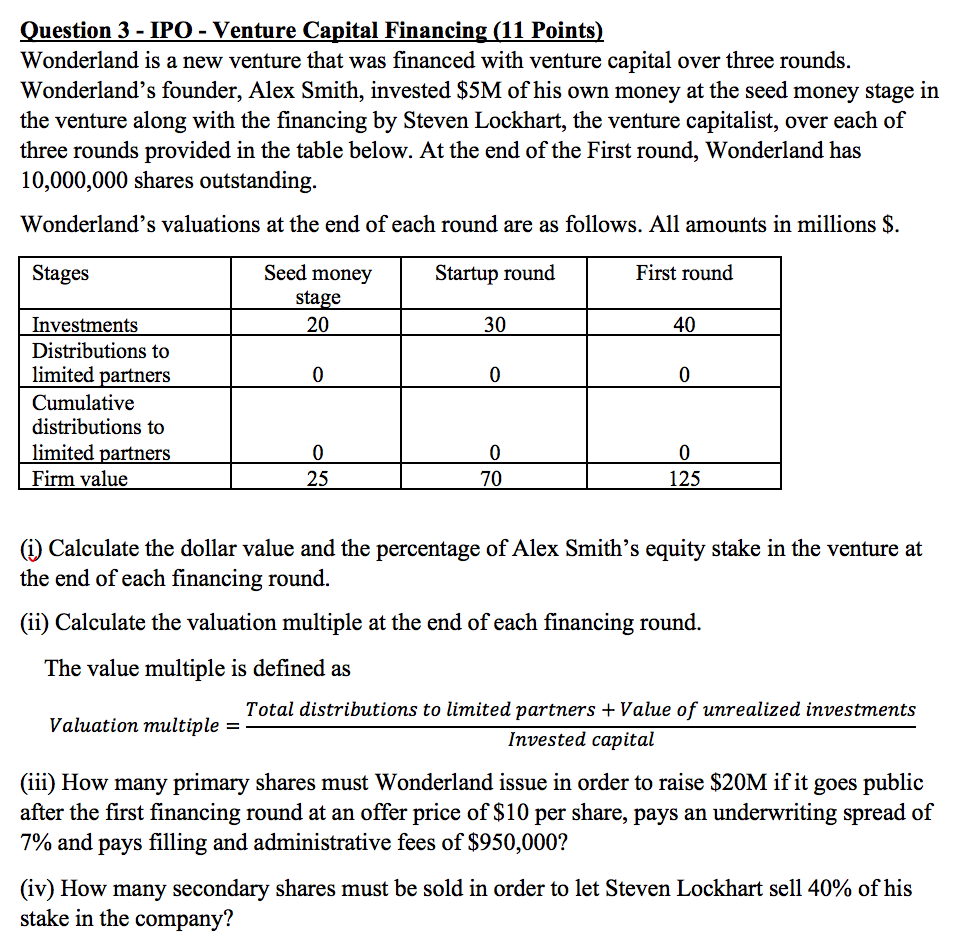

Question 3 - IPO - Venture Capital Financing (11 Points) Wonderland is a new venture that was financed with venture capital over three rounds. Wonderland's founder, Alex Smith, invested $5M of his own money at the seed money stage in the venture along with the financing by Steven Lockhart, the venture capitalist, over each of three rounds provided in the table below. At the end of the First round, Wonderland has 10,000,000 shares outstanding. Wonderland's valuations at the end of each round are as follows. All amounts in millions $. Stages Seed money stage Startup round First round 0 0 0 Investments Distributions to limited partners Cumulative distributions to limited partners Firm value 25 + 0 + 125 (i) Calculate the dollar value and the percentage of Alex Smith's equity stake in the venture at the end of each financing round. (ii) Calculate the valuation multiple at the end of each financing round. The value multiple is defined as Valuation multiple =- Total distributions to limited partners + Value of unrealized investments Invested capital (iii) How many primary shares must Wonderland issue in order to raise $20M if it goes public after the first financing round at an offer price of $10 per share, pays an underwriting spread of 7% and pays filling and administrative fees of $950,000? (iv) How many secondary shares must be sold in order to let Steven Lockhart sell 40% of his stake in the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts