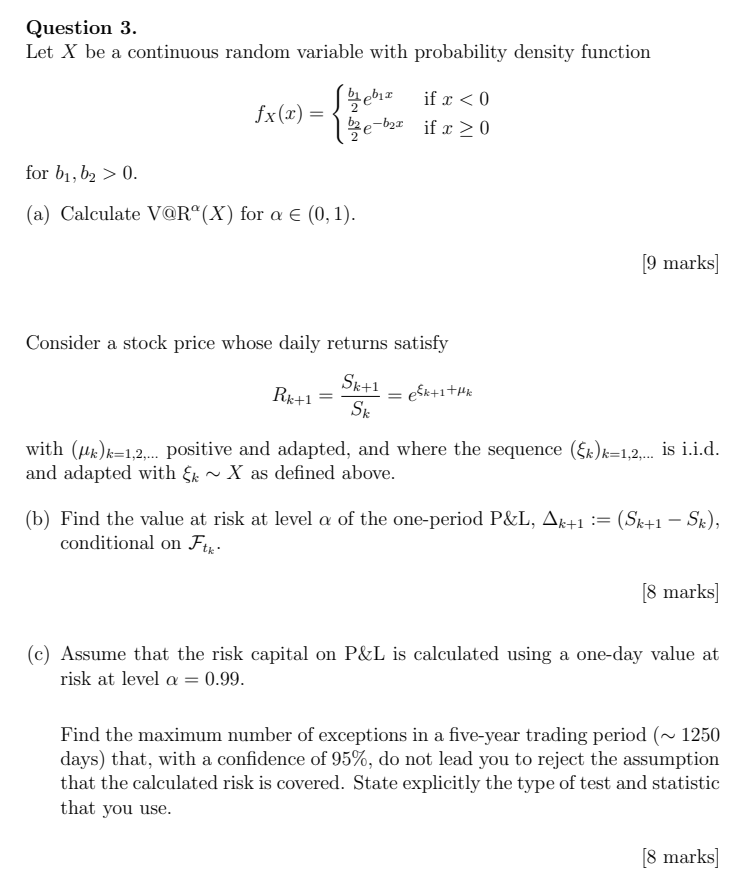

Question: Question 3. Let X be a continuous random variable with probability density function Sebiz if x 0 for b1,b2 > 0. (a) Calculate VQRC(X) for

Question 3. Let X be a continuous random variable with probability density function Sebiz if x 0 for b1,b2 > 0. (a) Calculate VQRC(X) for a (0,1). [9 marks] Consider a stock price whose daily returns satisfy Sk+1 Rx+1 = $k+1+uk Sk with (uk)k=1,2,... positive and adapted, and where the sequence (&k)k=1,2,.. is i.i.d. and adapted with Ek ~ X as defined above. (b) Find the value at risk at level a of the one-period P&L, Ak+1 := (Sk+1 - Sk), conditional on Ft [8 marks] (c) Assume that the risk capital on P&L is calculated using a one-day value at risk at level a = 0.99. Find the maximum number of exceptions in a five-year trading period (~ 1250 days) that, with a confidence of 95%, do not lead you to reject the assumption that the calculated risk is covered. State explicitly the type of test and statistic that you use. [8 marks] Question 3. Let X be a continuous random variable with probability density function Sebiz if x 0 for b1,b2 > 0. (a) Calculate VQRC(X) for a (0,1). [9 marks] Consider a stock price whose daily returns satisfy Sk+1 Rx+1 = $k+1+uk Sk with (uk)k=1,2,... positive and adapted, and where the sequence (&k)k=1,2,.. is i.i.d. and adapted with Ek ~ X as defined above. (b) Find the value at risk at level a of the one-period P&L, Ak+1 := (Sk+1 - Sk), conditional on Ft [8 marks] (c) Assume that the risk capital on P&L is calculated using a one-day value at risk at level a = 0.99. Find the maximum number of exceptions in a five-year trading period (~ 1250 days) that, with a confidence of 95%, do not lead you to reject the assumption that the calculated risk is covered. State explicitly the type of test and statistic that you use. [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts