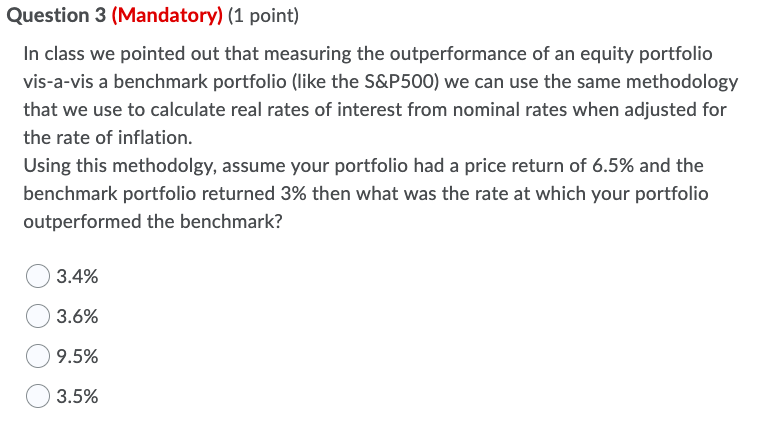

Question: Question 3 (Mandatory) (1 point) In class we pointed out that measuring the outperformance of an equity portfolio vis-a-vis a benchmark portfolio (like the S&P500)

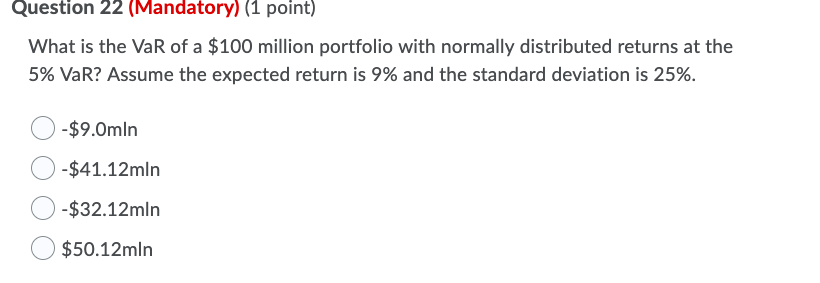

Question 3 (Mandatory) (1 point) In class we pointed out that measuring the outperformance of an equity portfolio vis-a-vis a benchmark portfolio (like the S&P500) we can use the same methodology that we use to calculate real rates of interest from nominal rates when adjusted for the rate of inflation. Using this methodolgy, assume your portfolio had a price return of 6.5% and the benchmark portfolio returned 3% then what was the rate at which your portfolio outperformed the benchmark? 3.4% 3.6% 9.5% 3.5% Question 22 (Mandatory) (1 point) What is the VaR of a $100 million portfolio with normally distributed returns at the 5% VaR? Assume the expected return is 9% and the standard deviation is 25%. 0-$9.0min 0-$41.12min 0-$32.12min $50.12min

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts