Question: Question 3: Mini case Study [02, 03] [ 5 marks] The Omani trade company manager put a plan to increase the days' sales outstanding in

![Question 3: Mini case Study [02, 03] [ 5 marks] The](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/670114a06ce00_0636701149fdf633.jpg)

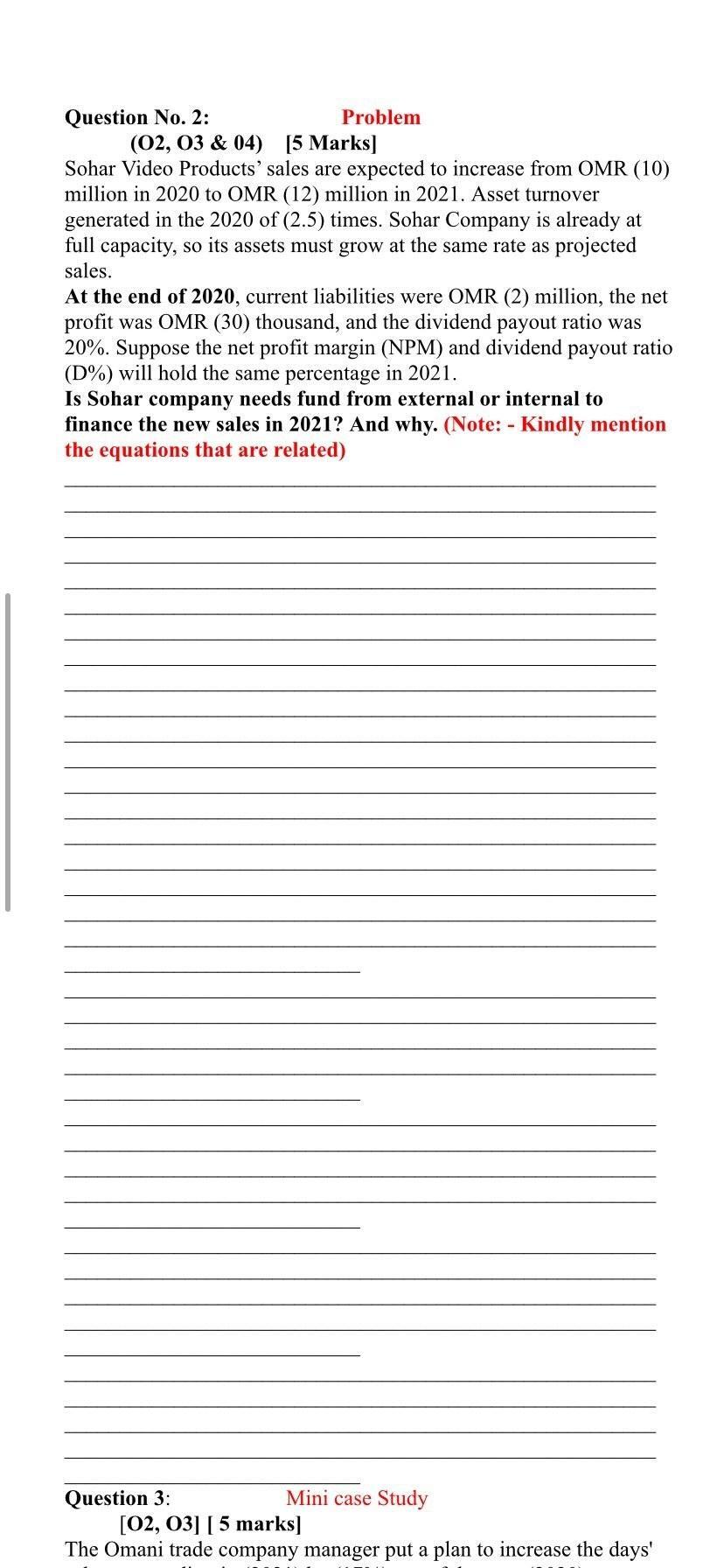

Question 3: Mini case Study [02, 03] [ 5 marks] The Omani trade company manager put a plan to increase the days' sales outstanding in (2021) by (17%) out of the year (2020). Suppose the other things are unchanged; how much will this plan add an amount to the accounts receivable? If you know, account receivable, and sales were (150, 2000) thousand RO in 2020, respectively. (Note: Write all related Equations regarding the questions) Question No. 2: Problem (02, 03 & 04) [5 Marks] Sohar Video Products' sales are expected to increase from OMR (10) million in 2020 to OMR (12) million in 2021. Asset turnover generated in the 2020 of (2.5) times. Sohar Company is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2020, current liabilities were OMR (2) million, the net profit was OMR (30) thousand, and the dividend payout ratio was 20%. Suppose the net profit margin (NPM) and dividend payout ratio (D%) will hold the same percentage in 2021. Is Sohar company needs fund from external or internal to finance the new sales in 2021? And why. (Note: - Kindly mention the equations that are related) Question 3: Mini case Study [02, 03] [5 marks] The Omani trade company manager put a plan to increase the days' Question 3: Mini case Study [02, 03] [ 5 marks] The Omani trade company manager put a plan to increase the days' sales outstanding in (2021) by (17%) out of the year (2020). Suppose the other things are unchanged; how much will this plan add an amount to the accounts receivable? If you know, account receivable, and sales were (150, 2000) thousand RO in 2020, respectively. (Note: Write all related Equations regarding the questions) Question No. 2: Problem (02, 03 & 04) [5 Marks] Sohar Video Products' sales are expected to increase from OMR (10) million in 2020 to OMR (12) million in 2021. Asset turnover generated in the 2020 of (2.5) times. Sohar Company is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2020, current liabilities were OMR (2) million, the net profit was OMR (30) thousand, and the dividend payout ratio was 20%. Suppose the net profit margin (NPM) and dividend payout ratio (D%) will hold the same percentage in 2021. Is Sohar company needs fund from external or internal to finance the new sales in 2021? And why. (Note: - Kindly mention the equations that are related) Question 3: Mini case Study [02, 03] [5 marks] The Omani trade company manager put a plan to increase the days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts