Question: Question 3: Non-current assets (17 marks) On 1 January 2016, Carlomagno Ltd purchased two machines by cash Machine A was purchased at a total cost

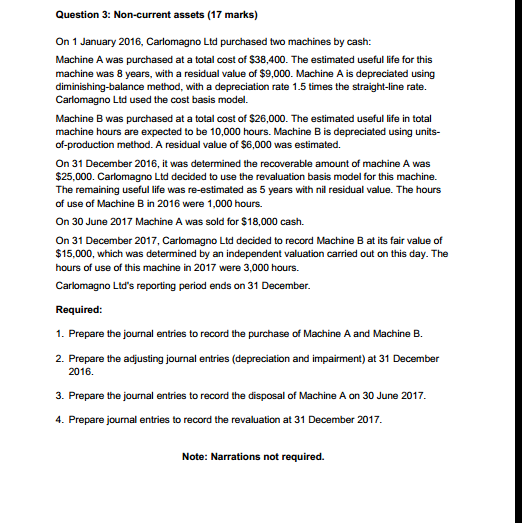

Question 3: Non-current assets (17 marks) On 1 January 2016, Carlomagno Ltd purchased two machines by cash Machine A was purchased at a total cost of $38,400. The estimated useful life for this machine was 8 years, with a residual value of $9,000. Machine A is depreciated using diminishing-balance method, with a depreciation rate 1.5 times the straight-line rate Carlomagno Ltd used the cost basis model. Machine B was purchased at a total cost of $26,000. The estimated useful life in total machine hours are expected to be 10,000 hours. Machine B is depreciated using units- of-production method. A residual value of $6,000 was estimated. On 31 December 2016, it was determined the recoverable amount of machine A was $25,000. Carlomagno Ltd decided to use the revaluation basis model for this machine The remaining useful life was re-estimated as 5 years with nil residual value. The hours of use of Machine B in 2016 were 1,000 hours. On 30 June 2017 Machine A was sold for $18,000 cash. On 31 December 2017, Carlomagno Ltd decided to record Machine B at its fair value of $15,000, which was determined by an independent valuation carried out on this day. The hours of use of this machine in 2017 were 3,000 hours. Carlomagno Ltd's reporting period ends on 31 December. Required: 1. Prepare the journal entries to record the purchase of Machine A and Machine B. 2. Prepare the adjusting journal entries (depreciation and impairment) at 31 December 2016. 3. Prepare the journal entries to record the disposal of Machine A on 30 June 2017 4. Prepare journal entries to record the revaluation at 31 December 2017. Note: Narrations not required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts