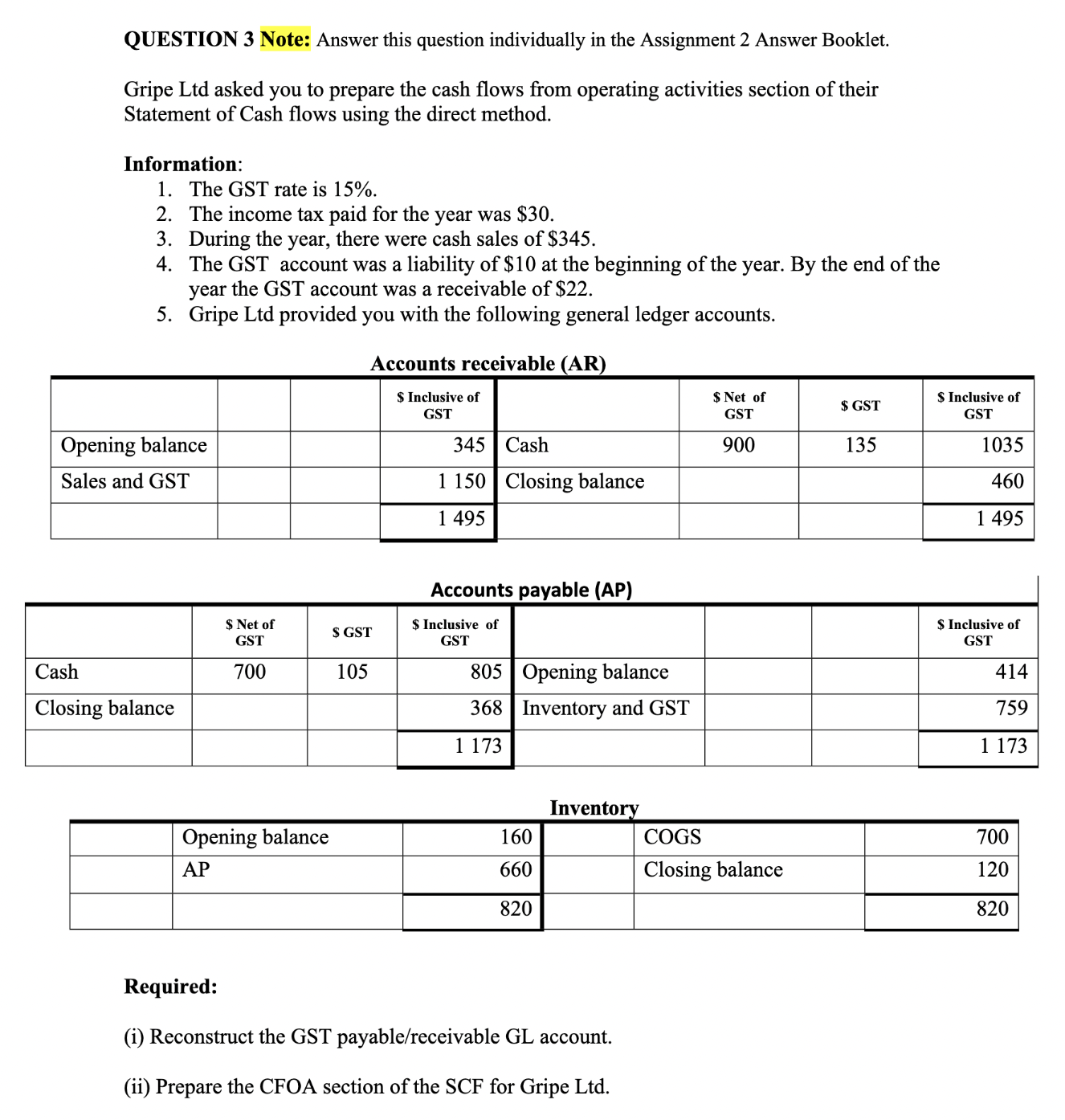

Question: QUESTION 3 Note: Answer this question individually in the Assignment 2 Answer Booklet. Gripe Ltd asked you to prepare the cash flows from operating activities

QUESTION Note: Answer this question individually in the Assignment Answer Booklet. Gripe Ltd asked you to prepare the cash flows from operating activities section of their Statement of Cash flows using the direct method. Information: The GST rate is The income tax paid for the year was $ During the year, there were cash sales of $ The GST account was a liability of $ at the beginning of the year. By the end of the year the GST account was a receivable of $ Gripe Ltd provided you with the following general ledger accounts. Accounts receivable AR Accounts payable AP Inventory Required: i Reconstruct the GST payablereceivable GL account. ii Prepare the CFOA section of the SCF for Gripe Ltd

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock