Question: Exercise 1 Consider a binomial pricing market model over N = 3 periods with a stock price S 0 = 1 0 0 and a

Exercise

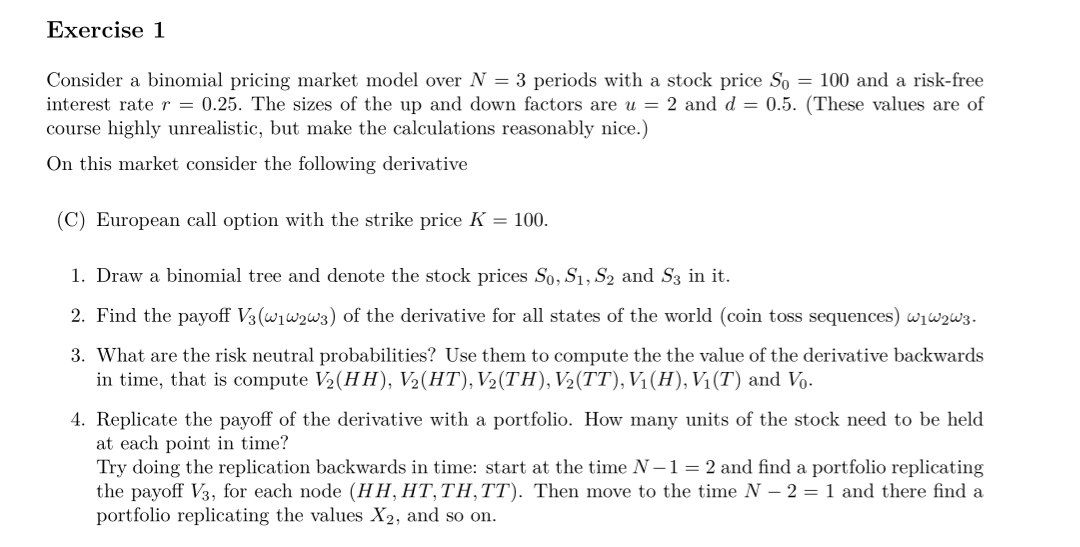

Consider a binomial pricing market model over periods with a stock price and a riskfree interest rate The sizes of the up and down factors are and These values are of course highly unrealistic, but make the calculations reasonably nice.

On this market consider the following derivative

C European call option with the strike price

Draw a binomial tree and denote the stock prices and in it

Find the payoff of the derivative for all states of the world coin toss sequences

What are the risk neutral probabilities? Use them to compute the the value of the derivative backwards in time, that is compute and

Replicate the payoff of the derivative with a portfolio. How many units of the stock need to be held at each point in time?

Try doing the replication backwards in time: start at the time and find a portfolio replicating the payoff for each node Then move to the time and there find a portfolio replicating the values and so on

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock