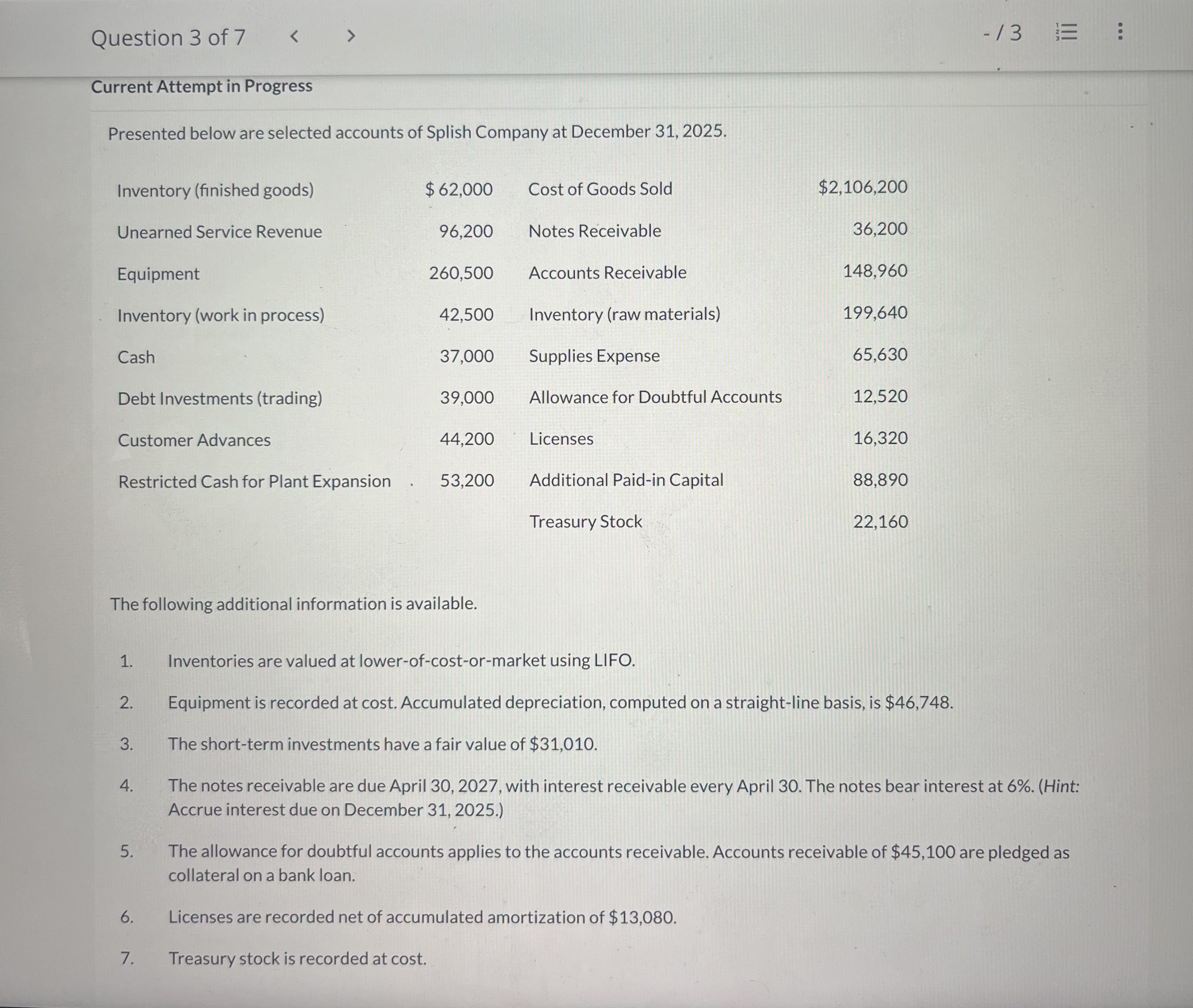

Question: Question 3 of 7 Current Attempt in Progress Presented below are selected accounts of Splish Company at December 3 1 , 2 0 2 5

Question of Current Attempt in Progress Presented below are selected accounts of Splish Company at December The following additional information is available. Inventories are valued at lowerofcostormarket using LIFO. Equipment is recorded at cost Accumulated depreciation, computed on a straightline basis, is $ The shortterm investments have a fair value of $ The notes receivable are due April with interest receivable every April The notes bear interest at Hint: Accrue interest due on December The allowance for doubtful accounts applies to the accounts receivable. Accounts receivable of $ are pledged as collateral on a bank loan. Licenses are recorded net of accumulated amortization of $ Treasury stock is recorded at cost SPLISH COMPANY

Balance Sheet Partial

$

Accumulated DepreciationEquipment

Accounts Receivable

Less vee : Allowance for Doubtful Accounts

Interest Receivable

Finished Goods

WorkinProcess

Raw Materials

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock