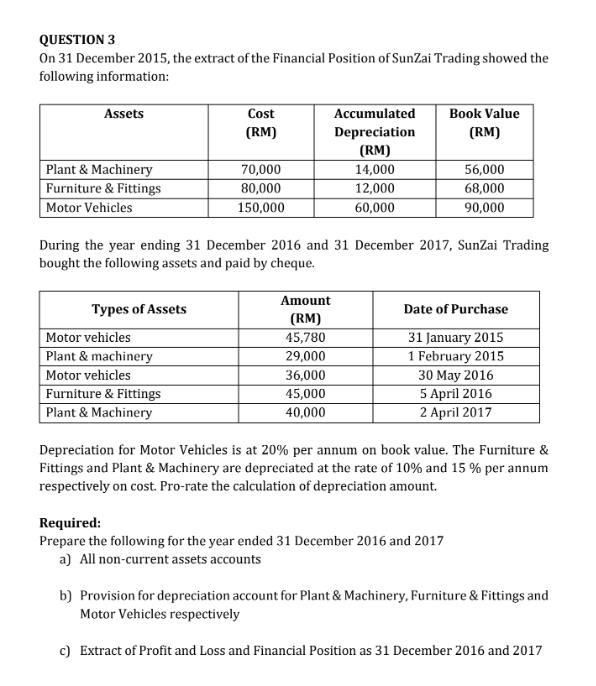

Question: QUESTION 3 On 3 1 December 2 0 1 5 , the extract of the Financial Position of SunZai Trading showed the following information:

QUESTION

On December the extract of the Financial Position of SunZai Trading showed the following information:

tableAssetstableCostRMtableAccumulatedDepreciationRMtableBook ValueRMPlant & Machinery,Furniture & Fittings,Motor Vehicles,

During the year ending December and December SunZai Trading bought the following assets and paid by cheque.

tableTypes of Assets,tableAmountRMDate of PurchaseMotor vehicles, January Plant & machinery, February Motor vehicles, May Furniture & Fittings, April Plant & Machinery, April

Depreciation for Motor Vehicles is at per annum on book value. The Furniture & Fittings and Plant & Machinery are depreciated at the rate of and per annum respectively on cost Prorate the calculation of depreciation amount.

Required:

Prepare the following for the year ended December and

a All noncurrent assets accounts

b Provision for depreciation account for Plant & Machinery, Furniture & Fittings and Motor Vehicles respectively

c Extract of Profit and Loss and Financial Position as December and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock