Question: Question: 3 On December 31, 2022. Z Electronics Ltd., a seller of electronic products has the following balances: Cash balance per book of $5.350. Bank

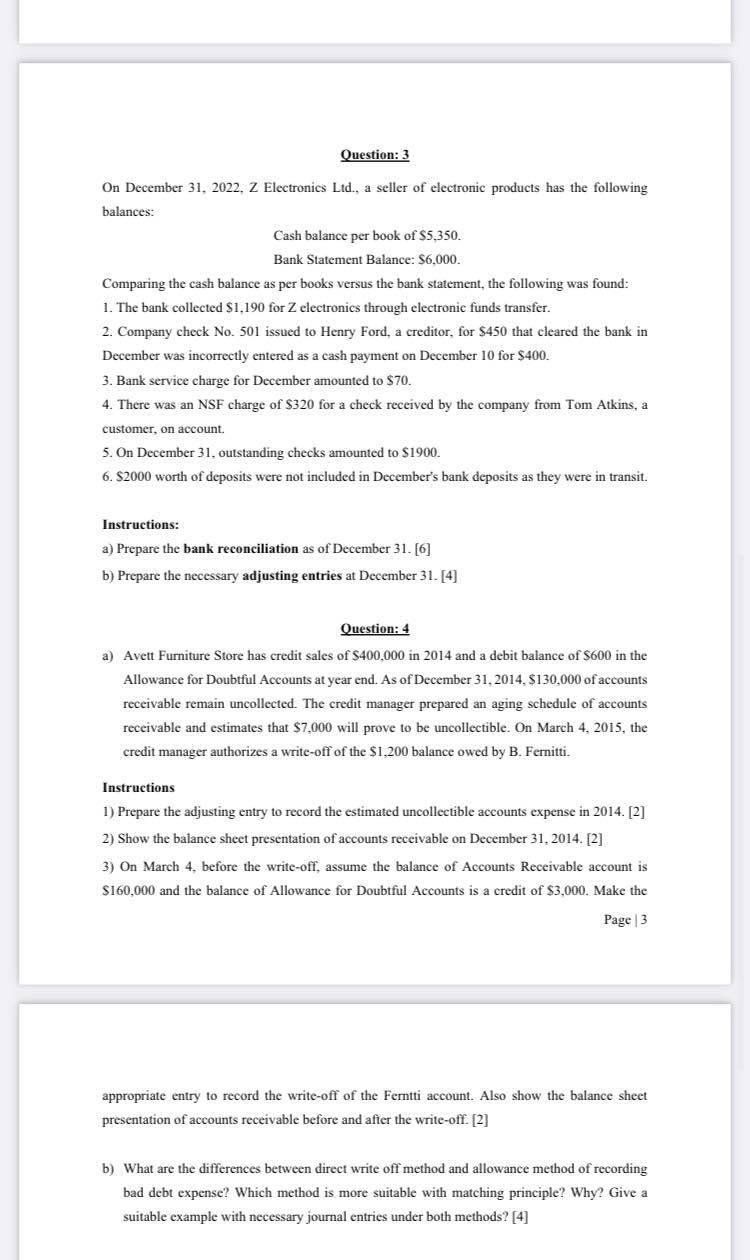

Question: 3 On December 31, 2022. Z Electronics Ltd., a seller of electronic products has the following balances: Cash balance per book of $5.350. Bank Statement Balance: $6.000. Comparing the cash balance as per books versus the bank statement, the following was found: 1. The bank collected $1.190 for electronics through electronic funds transfer. 2. Company check No. 501 issued to Henry Ford, a creditor, for $450 that cleared the bank in December was incorrectly entered as a cash payment on December 10 for $400. 3. Bank service charge for December amounted to $70. 4. There was an NSF charge of $320 for a check received by the company from Tom Atkins, a customer, on account 5. On December 31. outstanding checks amounted to $1900. 6. S2000 worth of deposits were not included in December's bank deposits as they were in transit. Instructions: a) Prepare the bank reconciliation as of December 31. [6] b) Prepare the necessary adjusting entries at December 31. [4] Question: 4 a) Avett Furniture Store has credit sales of $400,000 in 2014 and a debit balance of $600 in the Allowance for Doubtful Accounts at year end. As of December 31, 2014. $130,000 of accounts receivable remain uncollected. The credit manager prepared an aging schedule of accounts receivable and estimates that $7,000 will prove to be uncollectible. On March 4, 2015, the credit manager authorizes a write-off of the $1.200 balance owed by B. Fernitti. Instructions 1) Prepare the adjusting entry to record the estimated uncollectible accounts expense in 2014. [2] 2) Show the balance sheet presentation of accounts receivable on December 31, 2014. [2] 3) On March 4. before the write-off, assume the balance of Accounts Receivable account is $160,000 and the balance of Allowance for Doubtful Accounts is a credit of $3,000. Make the Page 3 appropriate entry to record the write-off of the Ferntti account. Also show the balance sheet presentation of accounts receivable before and after the write-off. [2] b) What are the differences between direct write off method and allowance method of recording bad debt expense? Which method is more suitable with matching principle? Why? Give a suitable example with necessary journal entries under both methods? [4]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts