Question: Question: 3 On December 31, 2022, Z Electronics Ltd., a seller of electronic products has the following balances: Cash balance per book of $5,350. Bank

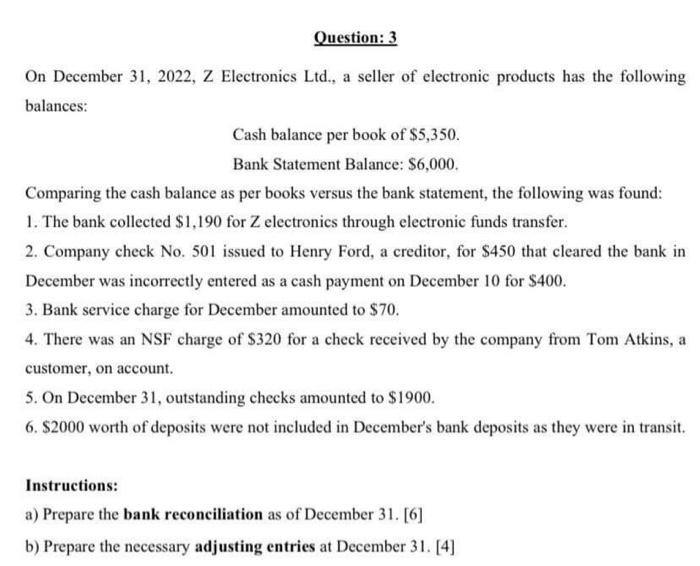

Question: 3 On December 31, 2022, Z Electronics Ltd., a seller of electronic products has the following balances: Cash balance per book of $5,350. Bank Statement Balance: $6,000. Comparing the cash balance as per books versus the bank statement, the following was found: 1. The bank collected $1,190 for Z electronics through electronic funds transfer. 2. Company check No. 501 issued to Henry Ford, a creditor, for $450 that cleared the bank in December was incorrectly entered as a cash payment on December 10 for $400. 3. Bank service charge for December amounted to $70. 4. There was an NSF charge of S320 for a check received by the company from Tom Atkins, a customer, on account. 5. On December 31, outstanding checks amounted to $1900. 6. $2000 worth of deposits were not included in December's bank deposits as they were in transit. Instructions: a) Prepare the bank reconciliation as of December 31. [6] b) Prepare the necessary adjusting entries at December 31. [4]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts