Question: Question 3: Option Valuation - Binomial Model (10 marks) QWERTY Corporation is a non dividend-paying stock that is currently priced at $50. The annual standard

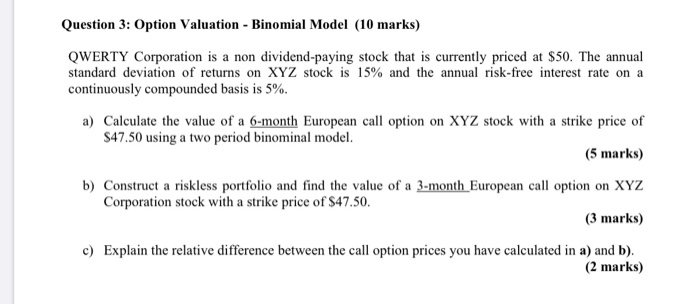

Question 3: Option Valuation - Binomial Model (10 marks) QWERTY Corporation is a non dividend-paying stock that is currently priced at $50. The annual standard deviation of returns on XYZ stock is 15% and the annual risk-free interest rate on a continuously compounded basis is 5%. a) Calculate the value of a 6-month European call option on XYZ stock with a strike price of $47.50 using a two period binominal model. (5 marks) b) Construct a riskless portfolio and find the value of a 3-month European call option on XYZ Corporation stock with a strike price of $47.50. (3 marks) c) Explain the relative difference between the call option prices you have calculated in a) and b). (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts