Question: Question 3 , P 1 2 . 4 ( similar to ) Part 1 of 5 HW Score: 9 5 % , 1 9 of

Question Psimilar to

Part of

HW Score: of

points

Points: of

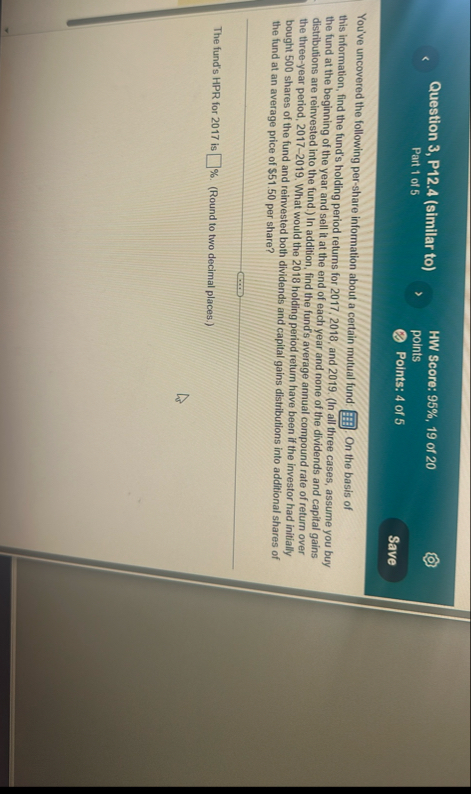

You've uncovered the following pershare information about a certain mutual fund: this information, find the fund's holding period returns for and In all three cases, assume you buy the fund at the beginning of the year and sell it at the end of each year and none of the dividends and capital gains distributions are reinvested into the fund. In addition, find the fund's average annual compound rate of return over the threeyear period, What would the holding period return have been if the investor had initially bought shares of the fund and reinvested both dividends and capital gains distributions into additional shares of the fund at an average price of $ per share?

The fund's HPR for is Round to two decimal places.tableCick on the icon here b in order to copy the contents of the data table below into a spreadsheet.Ending share prices:Ofler$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock