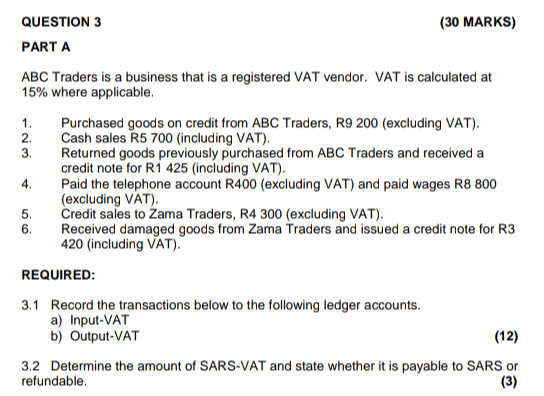

Question: QUESTION 3 PART A (30 MARKS) ABC Traders is a business that is a registered VAT vendor. VAT is calculated at 15% where applicable.

QUESTION 3 PART A (30 MARKS) ABC Traders is a business that is a registered VAT vendor. VAT is calculated at 15% where applicable. 1. 2. 3. 4. 56 6. Purchased goods on credit from ABC Traders, R9 200 (excluding VAT). Cash sales R5 700 (including VAT). Returned goods previously purchased from ABC Traders and received a credit note for R1 425 (including VAT). Paid the telephone account R400 (excluding VAT) and paid wages R8 800 (excluding VAT). Credit sales to Zama Traders, R4 300 (excluding VAT). Received damaged goods from Zama Traders and issued a credit note for R3 420 (including VAT). REQUIRED: 3.1 Record the transactions below to the following ledger accounts. a) Input-VAT b) Output-VAT (12) 3.2 Determine the amount of SARS-VAT and state whether it is payable to SARS or refundable. (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts