Question: Question 3 please 3. Last week Prudence Puffin analyzed three common stock portfolios. She will hold only one of these three portfolios in combination with

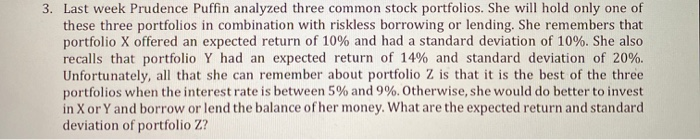

3. Last week Prudence Puffin analyzed three common stock portfolios. She will hold only one of these three portfolios in combination with riskless borrowing or lending. She remembers that portfolio X offered an expected return of 10% and had a standard deviation of 10%. She also recalls that portfolio Y had an expected return of 14% and standard deviation of 20%. Unfortunately, all that she can remember about portfolio Z is that it is the best of the three portfolios when the interest rate is between 5% and 9%. Otherwise, she would do better to invest in Xor Y and borrow or lend the balance of her money. What are the expected return and standard deviation of portfolio Z

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts