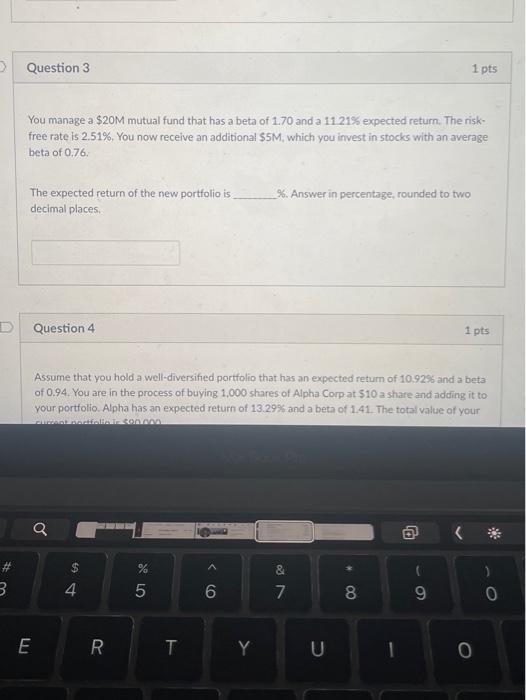

Question: Question 3 please Question 3 1 pts You manage a $20M mutual fund that has a beta of 1.70 and a 11 21% expected return.

Question 3 1 pts You manage a $20M mutual fund that has a beta of 1.70 and a 11 21% expected return. The risk- free rate is 2.51%, You now receive an additional $5M which you invest in stocks with an average beta of 0.76 The expected return of the new portfolio is decimal places %. Answer in percentage, rounded to two D Question 4 1 pts Assume that you hold a well-diversified portfolio that has an expected return of 10,92% and a beta of 0.94. You are in the process of buying 1,000 shares of Alpha Corp at $10 a share and adding it to your portfolio. Alpha has an expected return of 13.29% and a beta of 1.41. The total value of your BATAVARA a A & 3 4 5 6 7 8 9 0 E R T U O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts