Question: Question 3 Please show working. Question 3 Hambach plc provides you with the following trial balance at 31 December 2019: Debit () Credit (E) Sales

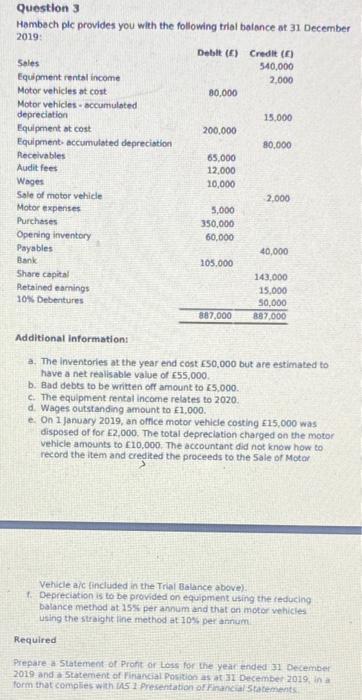

Question 3 Hambach plc provides you with the following trial balance at 31 December 2019: Debit () Credit (E) Sales 540,000 Equipment rental income 2,000 Motor vehicles at cost 80,000 Motor vehicles-accumulated depreciation 15,000 Equipment at cost 200,000 Equipment- accumulated depreciation 80,000 Receivables 65,000 Audit fees 12,000 Wages 10,000 Sale of motor vehicle 2,000 Motor expenses 5,000 Purchases 350,000 Opening inventory 60,000 Payables 40,000 Bank 105.000 143,000 Share capital Retained earnings 10% Debentures 15.000 50,000 887,000 887,000 Additional information: a. The inventories at the year end cost E50,000 but are estimated to have a net realisable value of 55,000. b. Bad debts to be written off amount to 5,000. c. The equipment rental income relates to 2020. d. Wages outstanding amount to 1,000. e. On 1 January 2019, an office motor vehicle costing 15,000 was disposed of for 2,000. The total depreciation charged on the motor vehicle amounts to 10,000. The accountant did not know how to record the item and credited the proceeds to the Sale of Motor Vehicle a/c (included in the Trial Balance above). f. Depreciation is to be provided on equipment using the reducing balance method at 15% per annum and that on motor vehicles using the straight line method at 10% per annum Required Prepare a Statement of Profit or Loss for the year ended 31 December 2019 and a Statement of Financial Position as at 31 December 2019, in a form that complies with IAS 1 Presentation of Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts