Question: question 3 pls. excel sheet is from question 1. Question 3 (15 points). Suppose a bond has the same characteristics as in Question 1. Part

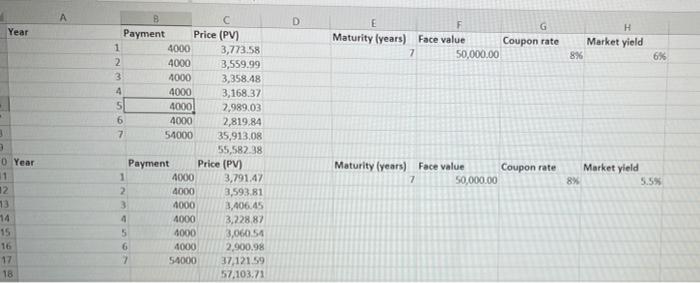

Question 3 (15 points). Suppose a bond has the same characteristics as in Question 1. Part A) Calculate the duration of the bond by constructing a table just like the one in the sample spreadsheet for this question. Tips: 1) Copy the data in your worksheet for Question 1 into the worksheet for this question. 2) Fill in column H using the appropriate Excel formulas and cell references. ("Share" is the share of the market price of the payment in the total market price of the bond.) 3) Fill in column I using the appropriate Excel formulas and cell references and then highlight the duration of the bond. Part B). Use the worksheet to calculate what the duration of the bond would be in each of the following cases: 1) the coupon rate is 2 percentage rates higher; 2) the market yield is 2 percentage points higher. Explain how you got your answers and what the intuition is for your answers. (Hint: You don't have to do a whole new worksheet. If you have the correct formulas and cell references, you only have to change one number in each case to get the answer.) A D Year Price (PV) E F G Maturity (years) Face value Coupon rate 7 50,000.00 H Market yield 8% 6% B Payment 1 4000 3,773.58 2 4000 3,559.99 3 4000 3,358.48 4 4000 3,168.37 5 40001 7,989.03 6 4000 2,819.84 7 54000 35,913.08 55,582.38 Payment Price (PV) 1 4000 3,791.47 2 4000 3,593.81 3 4000 3,406.45 4 4000 3,228 87 5 1000 3,060.54 6 4000 2.900.98 7 54000 37,121.59 57,103.71 Maturity (years) Face value Coupon rate 7 50,000.00 3 3 0 Year 11 2 13 14 15 16 17 18 Market yield 8% 5.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts