Question: Question 3 Points: 25 PART B Question 1 Dinamik Bhd is considering a new project. The initial outlay for this project is RM80,000 and expected

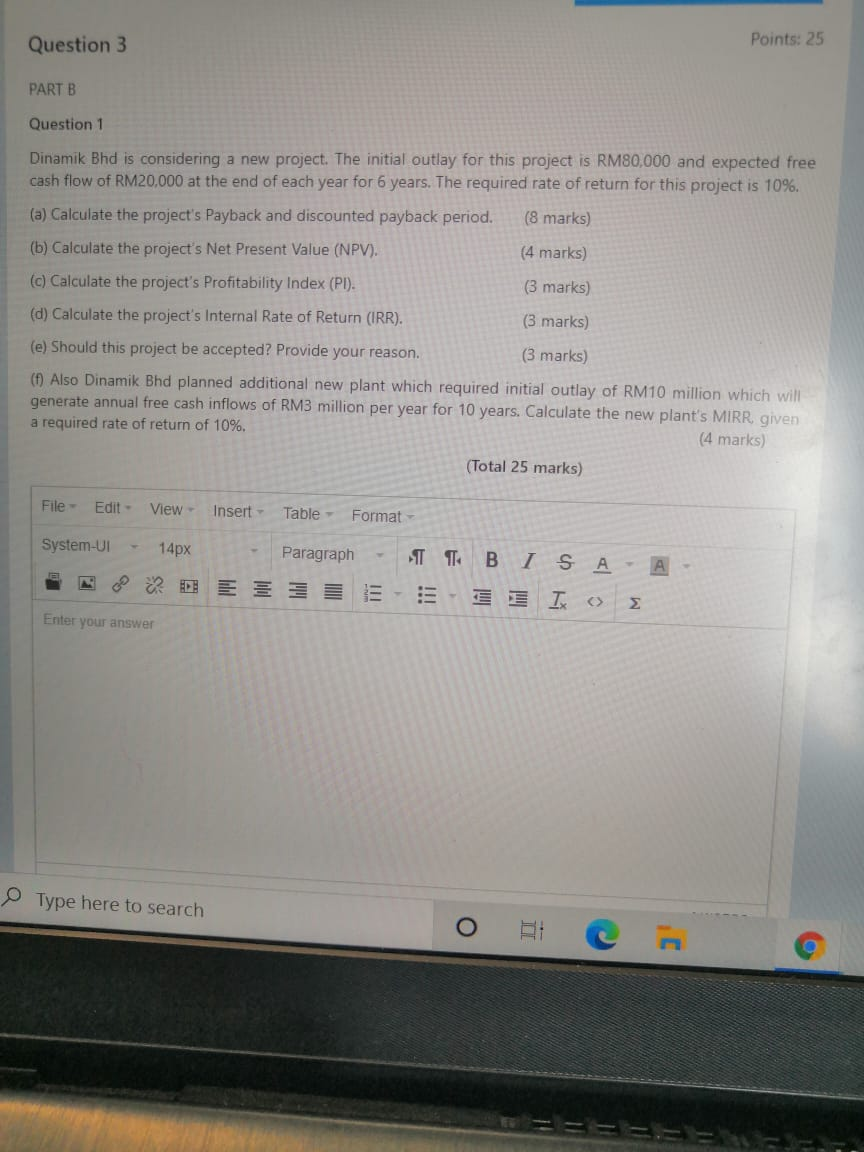

Question 3 Points: 25 PART B Question 1 Dinamik Bhd is considering a new project. The initial outlay for this project is RM80,000 and expected free cash flow of RM20,000 at the end of each year for 6 years. The required rate of return for this project is 10%. (a) Calculate the project's Payback and discounted payback period. (8 marks) (b) Calculate the project's Net Present Value (NPV). (4 marks) (c) Calculate the project's Profitability Index (PI). (3 marks) (d) Calculate the project's Internal Rate of Return (IRR). (3 marks) (e) Should this project be accepted? Provide your reason. (3 marks) (f) Also Dinamik Bhd planned additional new plant which required initial outlay of RM10 million which will generate annual free cash inflows of RM3 million per year for 10 years. Calculate the new plant's MIRR, given a required rate of return of 10%. (4 marks) (Total 25 marks) File- Edit View Insert - Table Format System-UI 14px Paragraph TTTT B I SAA EIKO Enter your answer Type here to search O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts