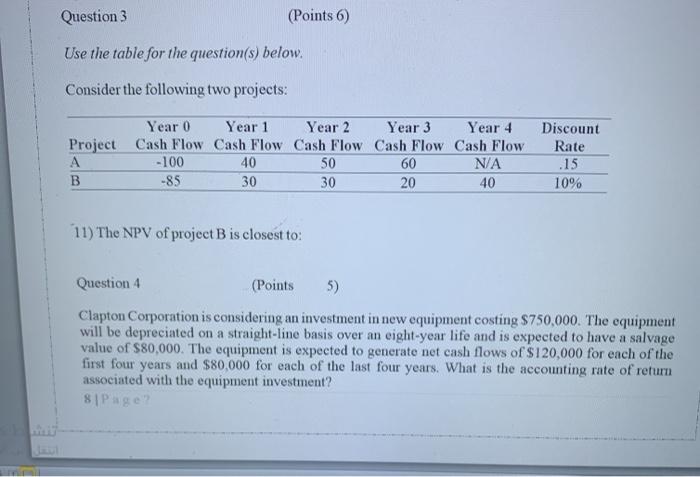

Question: Question 3 (Points 6) Use the table for the question(s) below. Consider the following two projects: Year 0 Year 1 Year 2 Year 3 Year

Question 3 (Points 6) Use the table for the question(s) below. Consider the following two projects: Year 0 Year 1 Year 2 Year 3 Year 4 Project Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow A -100 40 50 60 N/A B -85 30 30 20 40 Discount Rate .15 10% 11) The NPV of project B is closest to: Question 4 (Points 5) Clapton Corporation is considering an investment in new equipment costing $750,000. The equipment will be depreciated on a straight-line basis over an eight-year life and is expected to have a salvage value of $80,000. The equipment is expected to generate net cash flows of $120,000 for each of the first four years and $80,000 for each of the last four years. What is the accounting rate of return associated with the equipment investment? 8 Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts